Question: A new computer system is expected to cost $40 million and generate annual savings of $12 million over the next five years. What is the

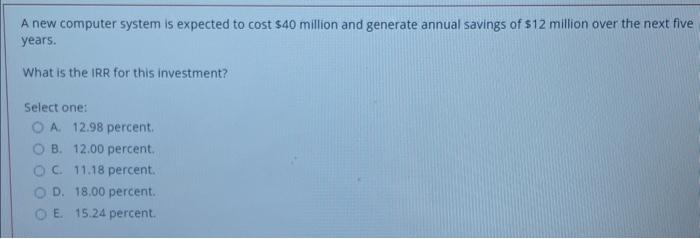

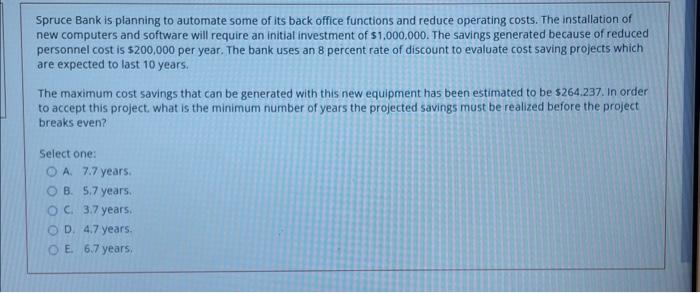

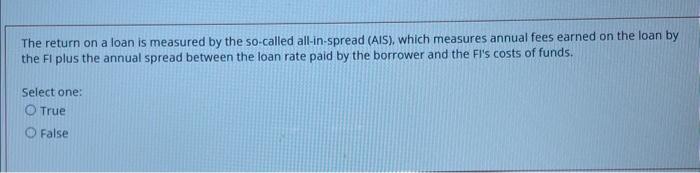

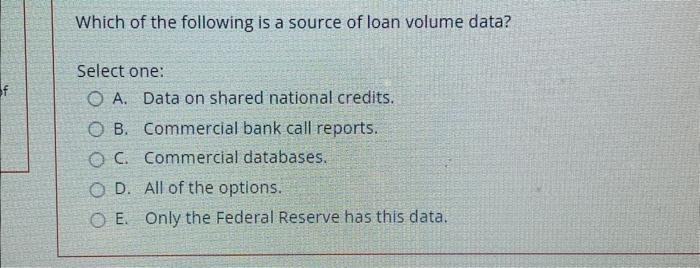

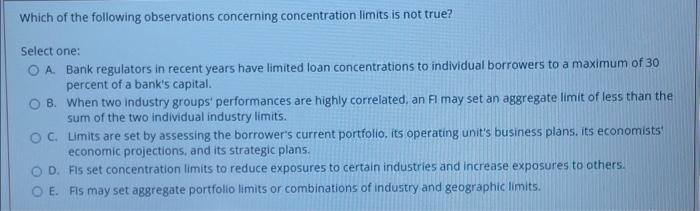

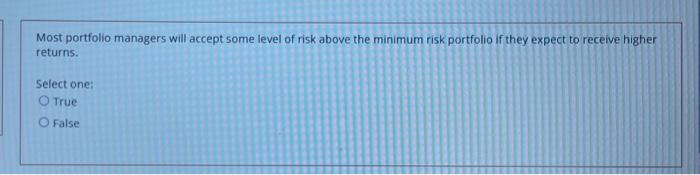

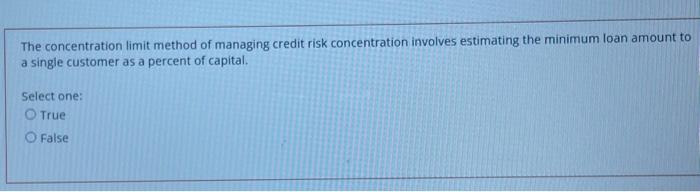

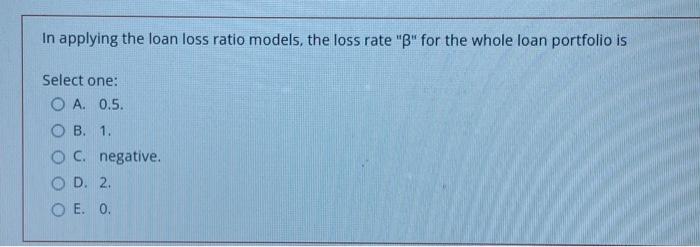

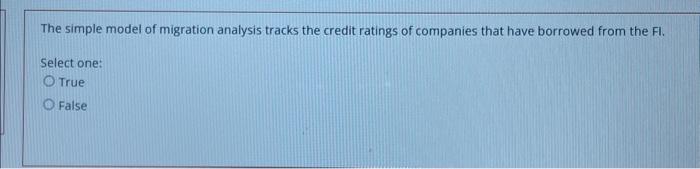

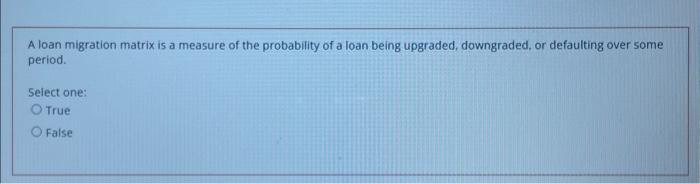

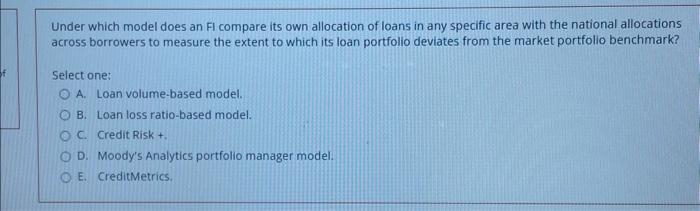

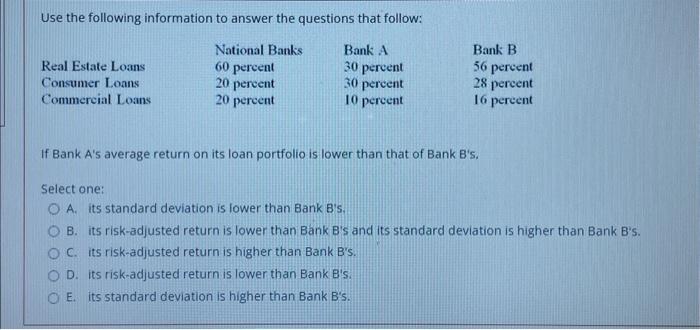

A new computer system is expected to cost $40 million and generate annual savings of $12 million over the next five years. What is the IRR for this investment? Select one: A. 12.98 percent. B. 12.00 percent. C. 11.18 percent. D. 18.00 percent. E. 15.24 percent. Spruce Bank is planning to automate some of its back office functions and reduce operating costs. The installation of new computers and software will require an initial investment of $1,000,000. The savings generated because of reduced personnel cost is $200,000 per year. The bank uses an 8 percent rate of discount to evaluate cost saving projects which are expected to last 10 years. The maximum cost savings that can be generated with this new equipment has been estimated to be $264.237. In order to accept this project, what is the minimum number of years the projected savings must be realized before the project breaks even? Select one: A. 7.7 years. B. 5.7 years. C. 3.7 years. D. 4.7 years. E. 6.7 years. The return on a loan is measured by the so-called all-in-spread (AIS), which measures annual fees earned on the loan by the FI plus the annual spread between the loan rate paid by the borrower and the FI's costs of funds. Select one: True False Which of the following is a source of loan volume data? Select one: A. Data on shared national credits. B. Commercial bank call reports. C. Commercial databases. D. All of the options. E. Only the Federal Reserve has this data. Which of the following observations concerning concentration limits is not true? Select one: A. Bank regulators in recent years have limited loan concentrations to individual borrowers to a maximum of 30 percent of a bank's capital. 8. When two industry groups' performances are highly correlated, an FI may set an aggregate limit of less than the sum of the two individual industry limits. C. Limits are set by assessing the borrower's current portfolio, its operating unit's business plans. its economists' economic projections, and its strategic plans. D. Fis set concentration limits to reduce exposures to certain industries and increase exposures to others. E. Fis may set aggregate portfolio limits or combinations of industry and geographic limits. Most portfolio managers will accept some level of risk above the minimum risk portfolio if they expect to receive higher returns. Select one: True False The concentration limit method of managing credit risk concentration involves estimating the minimum loan amount to a single customer as a percent of capital. Select one: True False In applying the loan loss ratio models, the loss rate " " for the whole loan portfolio is Select one: A. 0.5 . B. 1. C. negative. D. 2. E. 0 . The simple model of migration analysis tracks the credit ratings of companies that have borrowed from the Fi. Select one: true False A loan migration matrix is a measure of the probability of a loan being upgraded, downgraded, or defaulting over some period. Select one: True False Use the following information to answer the questions that follow: If Bank A's average return on its loan portfolio is lower than that of Bank B's. Select one: A. its standard deviation is lower than Bank B's. B. its risk-adjusted return is lower than Bank B's and its standard deviation is higher than Bank B's. C. its risk-adjusted return is higher than Bank B's. D. its risk-adjusted return is lower than Bank B's. E. its standard deviation is higher than Bank B's

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts