Question: A new machine costing $ 7 5 0 , 0 0 0 will yield cash savings of $ 2 5 0 , 0 0 0

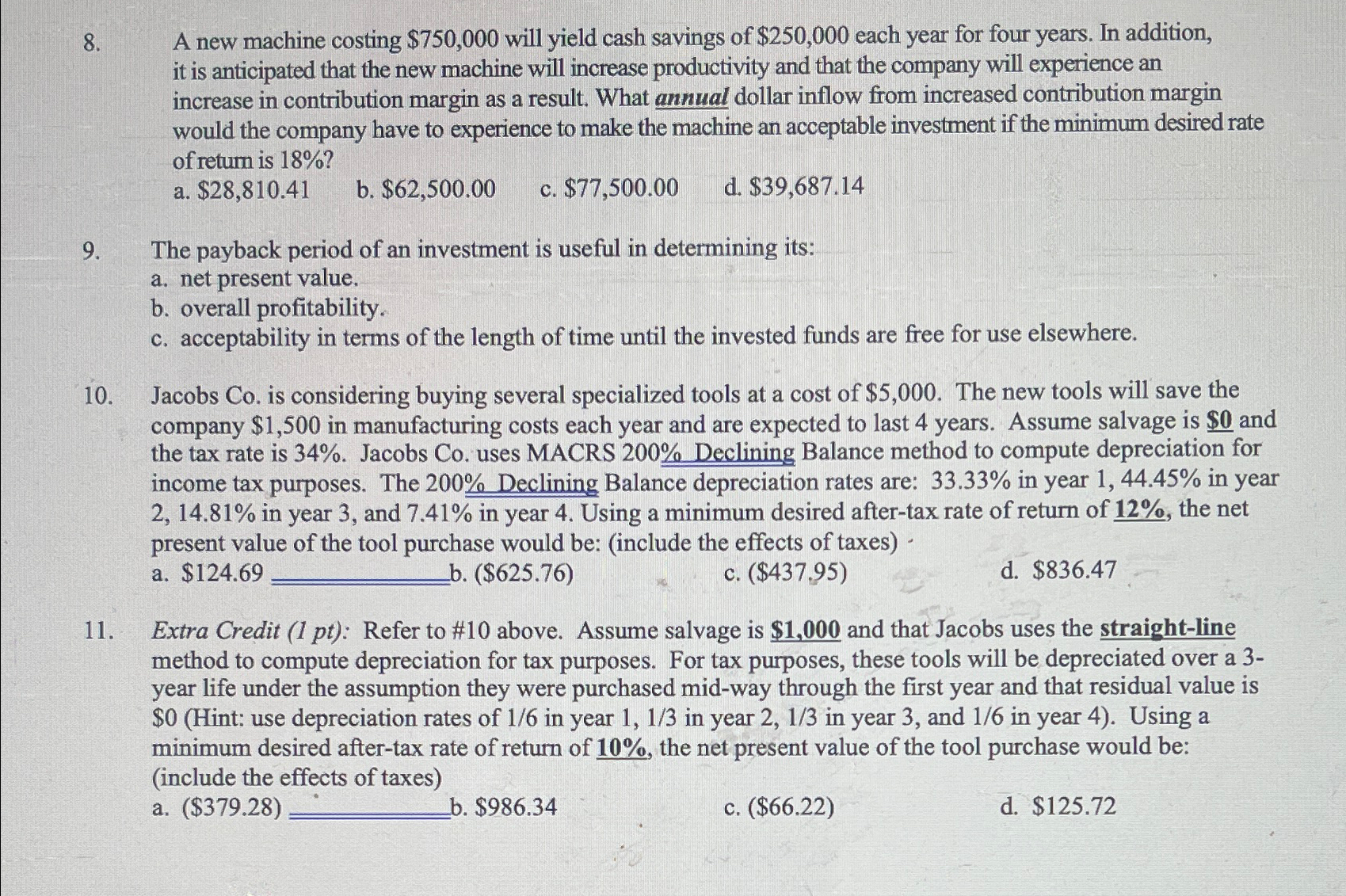

A new machine costing $ will yield cash savings of $ each year for four years. In addition, it is anticipated that the new machine will increase productivity and that the company will experience an increase in contribution margin as a result. What annual dollar inflow from increased contribution margin would the company have to experience to make the machine an acceptable investment if the minimum desired rate of return is

a $

b $

c $

d $

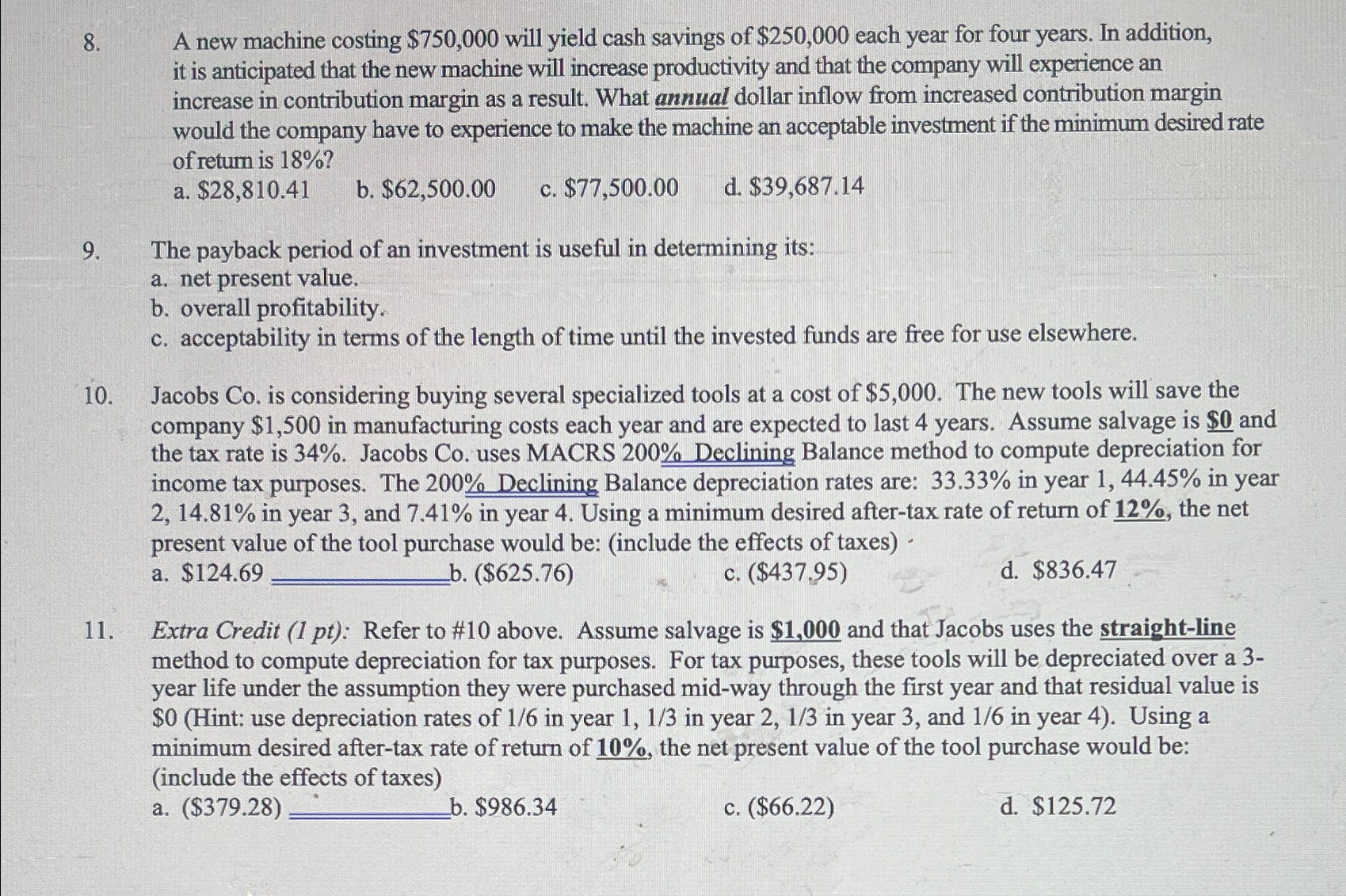

The payback period of an investment is useful in determining its:

a net present value.

b overall profitability.

c acceptability in terms of the length of time until the invested funds are free for use elsewhere.

Jacobs Co is considering buying several specialized tools at a cost of $ The new tools will save the company $ in manufacturing costs each year and are expected to last years. Assume salvage is $ and the tax rate is Jacobs Co uses MACRS Declining Balance method to compute depreciation for income tax purposes. The Declining Balance depreciation rates are: in year in year in year and in year Using a minimum desired aftertax rate of return of the net present value of the tool purchase would be: include the effects of taxes

a $

$

c$

d $

Extra Credit pt: Refer to # above. Assume salvage is $ and that Jacobs uses the straightline method to compute depreciation for tax purposes. For tax purposes, these tools will be depreciated over a year life under the assumption they were purchased midway through the first year and that residual value is $Hint: use depreciation rates of in year in year in year and in year Using a minimum desired aftertax rate of return of the net present value of the tool purchase would be: include the effects of taxes

a$

$

c$

d $

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock