Question: A new three-year CMO has two tranches. The 'A' tranche has a principal of $39.1 million with an annual coupon of 3.97%. The 'Z'

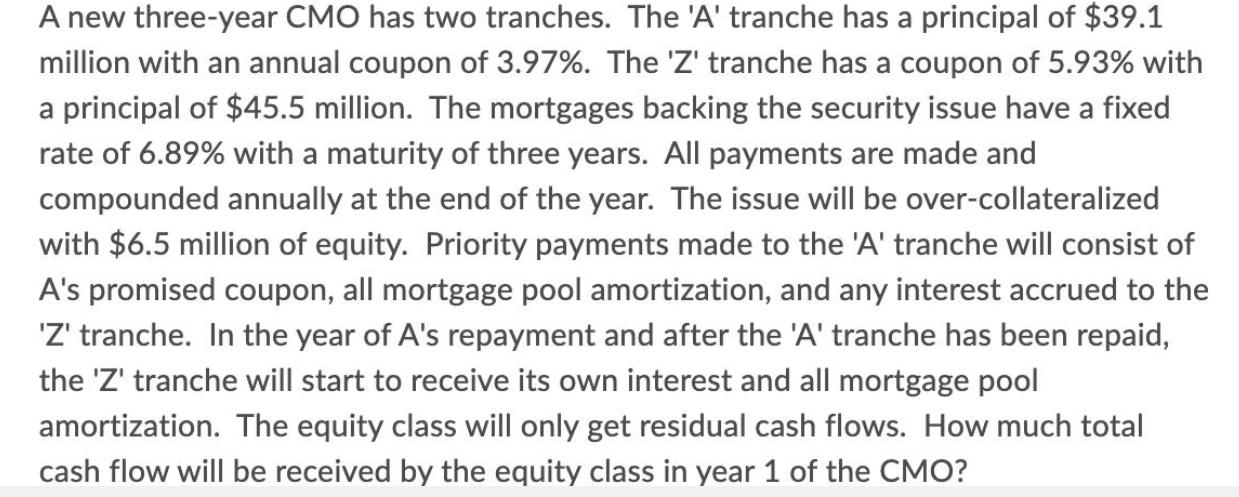

A new three-year CMO has two tranches. The 'A' tranche has a principal of $39.1 million with an annual coupon of 3.97%. The 'Z' tranche has a coupon of 5.93% with a principal of $45.5 million. The mortgages backing the security issue have a fixed rate of 6.89% with a maturity of three years. All payments are made and compounded annually at the end of the year. The issue will be over-collateralized with $6.5 million of equity. Priority payments made to the 'A' tranche will consist of A's promised coupon, all mortgage pool amortization, and any interest accrued to the 'Z' tranche. In the year of A's repayment and after the 'A' tranche has been repaid, the 'Z' tranche will start to receive its own interest and all mortgage pool amortization. The equity class will only get residual cash flows. How much total cash flow will be received by the equity class in year 1 of the CMO?

Step by Step Solution

There are 3 Steps involved in it

To calculate the total cash flow received by the equity class in year 1 of the CMO we need to consider the cash flows to the A tranche the Z tranche a... View full answer

Get step-by-step solutions from verified subject matter experts