Question: A newly-established business is considering two mutually-exclusive projects with the following forecasted cash flows: a. Calculate each projects IRR. b. Calculate each projects MIRR, assuming

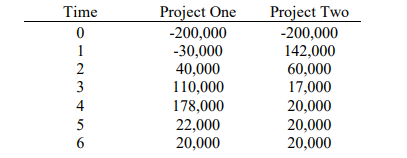

A newly-established business is considering two mutually-exclusive projects with the following forecasted cash flows:

a. Calculate each projects IRR.

b. Calculate each projects MIRR, assuming the cost of capital is 10%.

c. Calculate each projects NPV at discount rates of 0%, 5%, 10%, and 15%.

d. Calculate the incremental IRR (i.e., the crossover rate).

e. Construct an NPV profile to illustrate how the choice between the two projects depends on the discount rate and make sure that you explicitly state all the conclusions to be drawn from the NPV profile.

Time 0 1 2 3 4. 5 6 Project One -200,000 -30,000 40,000 110,000 178,000 22,000 20,000 Project Two -200,000 142,000 60,000 17,000 20,000 20,000 20,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts