Question: Mickey Ltd is considering two mutually-exclusive projects with the following details: Assume that the initial investment is at the start of the project and the

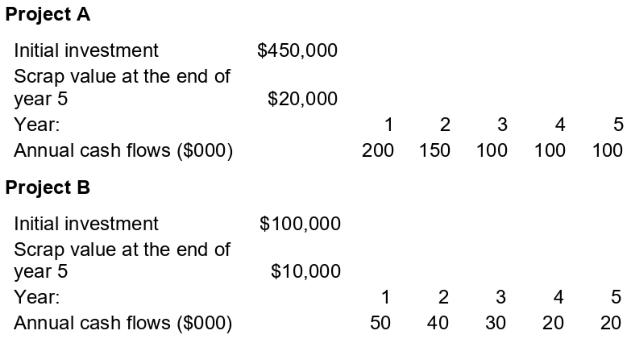

Mickey Ltd is considering two mutually-exclusive projects with the following details:

Assume that the initial investment is at the start of the project and the annual cash flows are at the end of each year.

Required

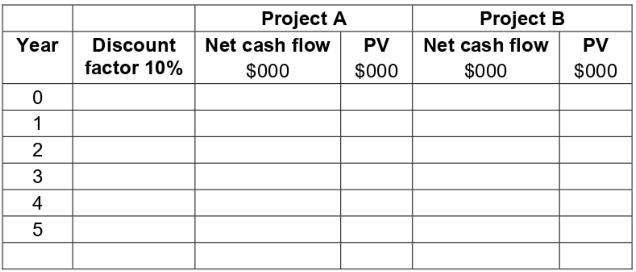

Calculate the Net Present Value for Projects A and B if the relevant cost of capital is $10 \%$.

Calculate which project has the highest NPV.

Project A Initial investment $450,000 Scrap value at the end of year 5 $20,000 Year: 1 Annual cash flows ($000) 200 Project B 2 3 4 5 150 100 100 100 Initial investment $100,000 Scrap value at the end of year 5 $10,000 Year: 1 N 2 Annual cash flows ($000) 50 50 40 33 4 52 30 20 20

Step by Step Solution

3.38 Rating (154 Votes )

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts