Question: A one year zero coupon bond is priced at 97.75. Show by calculation that the one year spot rate implied by the Bond price is

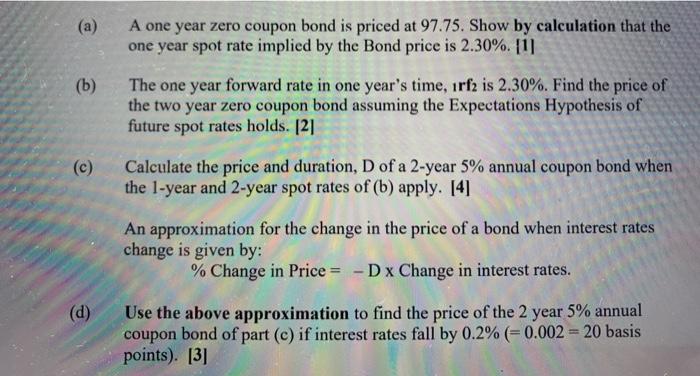

A one year zero coupon bond is priced at 97.75. Show by calculation that the one year spot rate implied by the Bond price is 2.30%. [1] (b) The one year forward rate in one year's time, irf is 2.30%. Find the price of the two year zero coupon bond assuming the Expectations Hypothesis of future spot rates holds. 121 (c) Calculate the price and duration, D of a 2-year 5% annual coupon bond when the 1-year and 2-year spot rates of (b) apply. [4] An approximation for the change in the price of a bond when interest rates change is given by: % Change in Price = - Dx Change in interest rates. (d) Use the above approximation to find the price of the 2 year 5% annual coupon bond of part (c) if interest rates fall by 0.2% (=0.002 = 20 basis points). [3]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts