Question: Please show all your work and steps! Thank you! 2. A one year zero coupon bond has a yield to maturity of 5%, a two

Please show all your work and steps! Thank you!

Please show all your work and steps! Thank you!

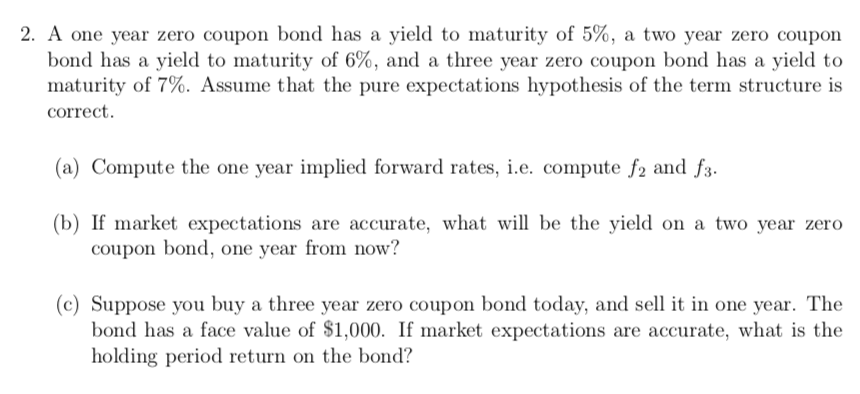

2. A one year zero coupon bond has a yield to maturity of 5%, a two year zero coupon bond has a yield to maturity of 6%, and a three year zero coupon bond has a yield to maturity of 7%. Assume that the pure expectations hypothesis of the term structure is correct. (a) Compute the one year implied forward rates, i.e. compute f2 and f3. (b) If market expectations are accurate, what will be the yield on a two year zero coupon bond, one year from now? (c) Suppose you buy a three year zero coupon bond today, and sell it in one year. The bond has a face value of $1,000. If market expectations are accurate, what is the holding period return on the bond

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts