Question: A one year zero coupon bond X will be pay either 1000 (par value)for 450 (default value) at maturity you observe that this bond currently

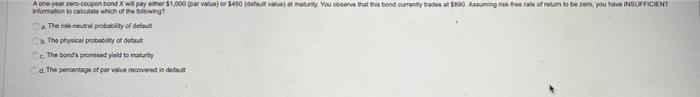

A one-year zero-coupon bond X will pay ether $1.000 (par value) or $450 (default value) at maturity. You observe that this bond currently trades at $890. Assuming risk free rate of retum to be zero, you have INSUFFICIENT information to calculate which of the following? a. The risk neutral probability of default b. The physical probability of defaut The bond's promised yield to maturity d. The percentage of par value recovered in default

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts