Question: A partial two-stage binomial tree is shown below for an American call option with a strike price of $155, spot price of $154, and volatility

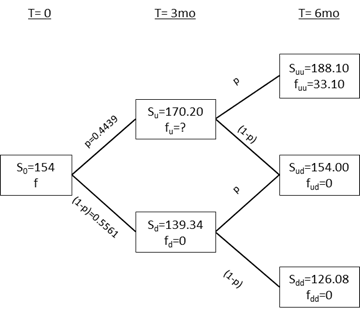

A partial two-stage binomial tree is shown below for an American call option with a strike price of $155, spot price of $154, and volatility () of 20%. The risk-free rate is 1% per annum compounded continuously. What is the option price (fu), 3-months from now (t=3-months)?

Group of answer choices

fu 5

5 u 7.5

7.5 u 10.0

10.0 u 12.5

fu > 12.5

T=0 T= 3mo T= 6mo Suu=188.10 fuu=33.10 Sy=170.20 f,=? (1-P) - p=0.4439 So=154 f Sud=154.00 fud=0 (1-2)=0.5561 Sg-139.34 fq=0 (1-0) Sca=126.08 fd=0

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts