Question: > A Pension Fund Manager is considering three mutual funds. The first is a stock fund, the second is a long-term government bond fund, and

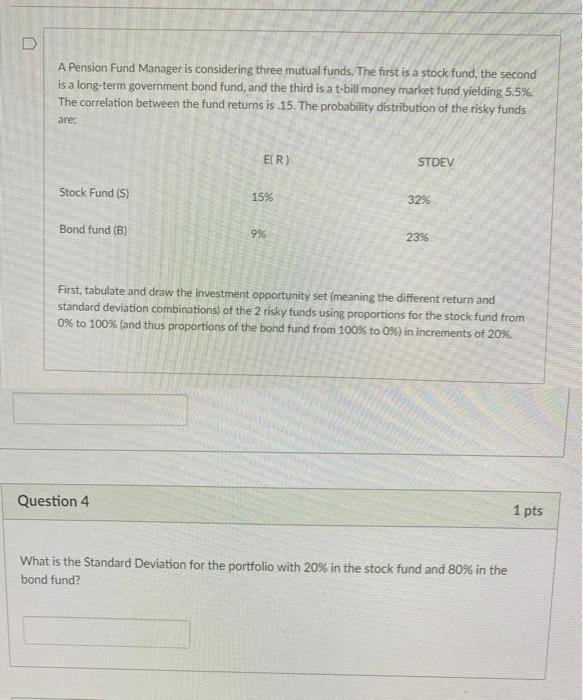

> A Pension Fund Manager is considering three mutual funds. The first is a stock fund, the second is a long-term government bond fund, and the third is a t-bill money market fund yielding 5.5%. The correlation between the fund returns is 15. The probability distribution of the risky funds are: E(R) STDEV STDEV Stock Fund (S) 15% 32% Bond fund (B) 9% 2396 First, tabulate and draw the investment opportunity set (meaning the different return and standard deviation combinations) of the 2 risky funds using proportions for the stock fund from 0% to 100% (and thus proportions of the bond fund from 100% to 0%) in increments of 20%. Question 4 1 pts What is the Standard Deviation for the portfolio with 20% in the stock fund and 80% in the bond fund

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts