Question: A. Please answer the following five questions (a to e) based on the XYZ Bank's financial statements, etc. (10 points): The balance sheet of

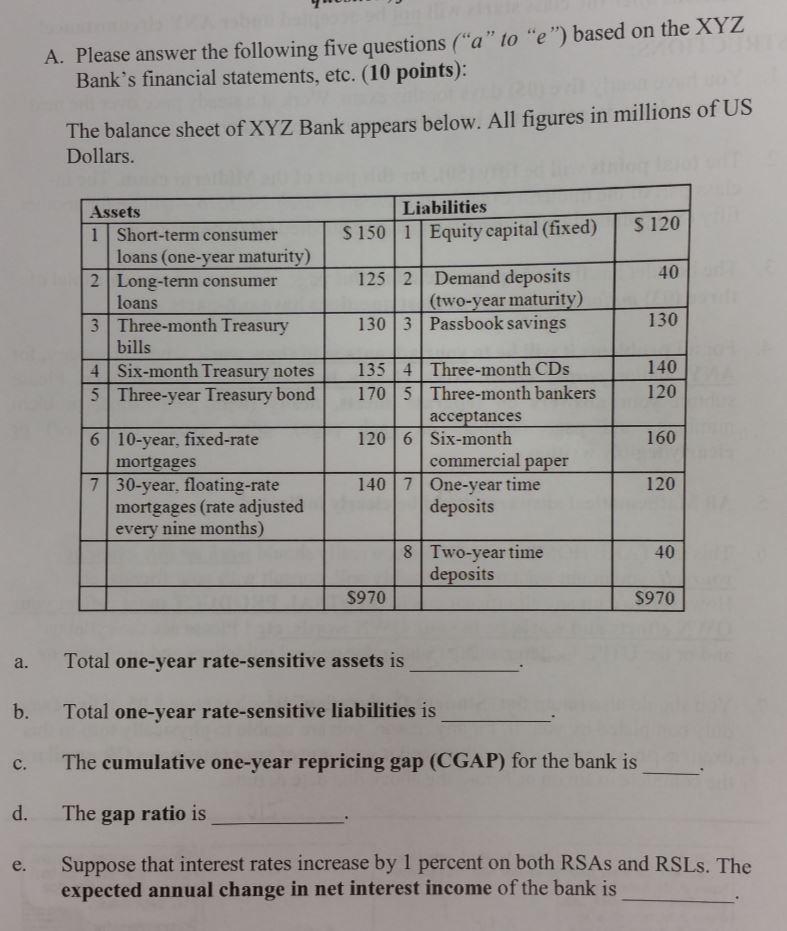

A. Please answer the following five questions ("a" to "e") based on the XYZ Bank's financial statements, etc. (10 points): The balance sheet of XYZ Bank appears below. All figures in millions of US Dollars. Assets Liabilities S 120 S 150 1 Equity capital (fixed) 1 Short-term consumer loans (one-year maturity) 2 Long-term consumer loans 40 125 2 Demand deposits (two-year maturity) 130 3 Passbook savings 3 Three-month Treasury 130 bills 135 4 Three-month CDs 170 5 Three-month bankers 4 Six-month Treasury notes 140 5 Three-year Treasury bond 120 acceptances 120 6 Six-month 6 10-year, fixed-rate 160 mortgages 7 30-year, floating-rate mortgages (rate adjusted every nine months) commercial paper 140 7 One-year time deposits 120 8 Two-year time deposits 40 $970 S970 a. Total one-year rate-sensitive assets is Total one-year rate-sensitive liabilities is . The cumulative one-year repricing gap (CGAP) for the bank is d. The gap ratio is Suppose that interest rates increase by 1 percent on both RSAS and RSLS. The expected annual change in net interest income of the bank is e.

Step by Step Solution

3.43 Rating (159 Votes )

There are 3 Steps involved in it

Solution rate Total one Jear denaitive anch dhort kerm Con... View full answer

Get step-by-step solutions from verified subject matter experts