Question: A plot of the yields on bonds with different terms to maturity but the same risk, liquidity, and tax considerations is known as A .

A plot of the yields on bonds with different terms to maturity but the same risk, liquidity, and tax considerations is known as

A an interestrate curve.

B a riskstructure curve.

D a termstructure curve.

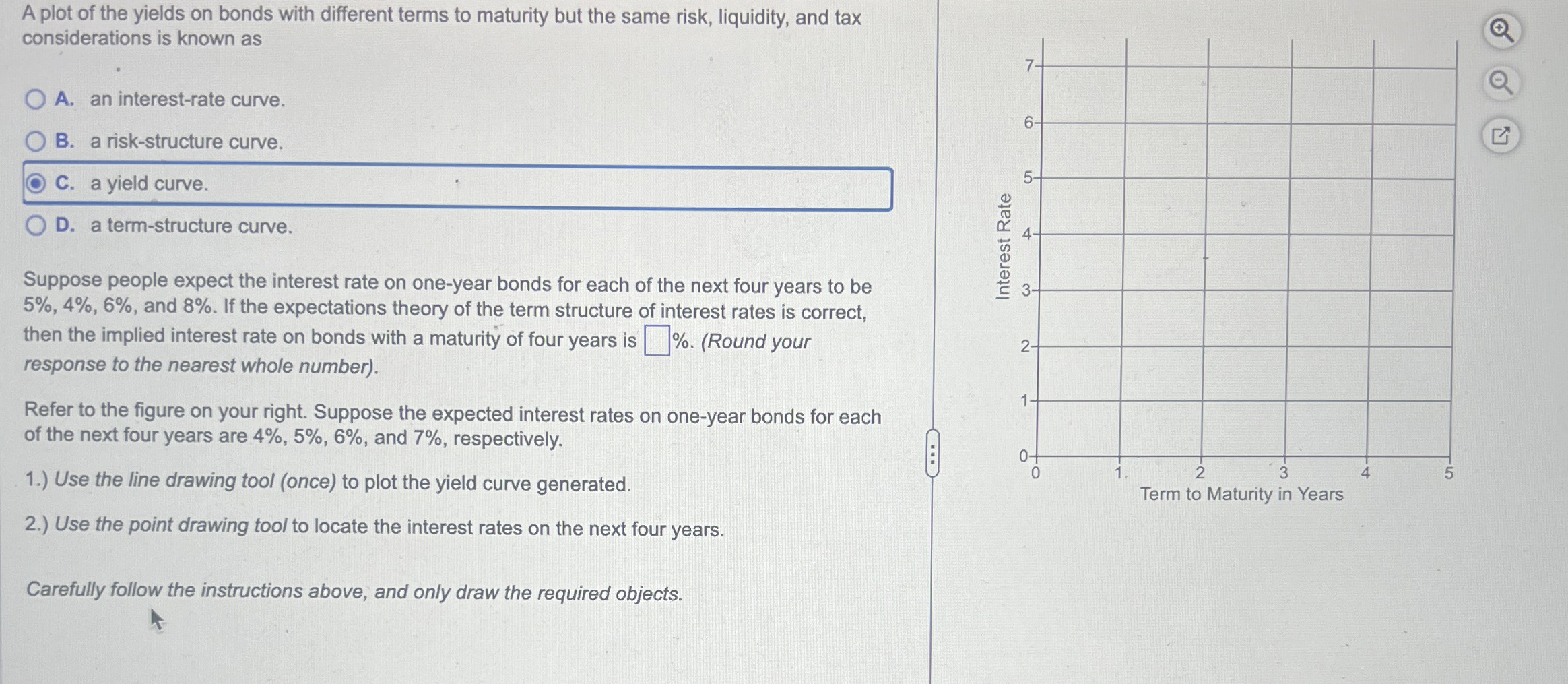

Suppose people expect the interest rate on oneyear bonds for each of the next four years to be and If the expectations theory of the term structure of interest rates is correct, then the implied interest rate on bonds with a maturity of four years is Round your response to the nearest whole number

Refer to the figure on your right. Suppose the expected interest rates on oneyear bonds for each of the next four years are and respectively.

Use the line drawing tool once to plot the yield curve generated.

Use the point drawing tool to locate the interest rates on the next four years.

Carefully follow the instructions above, and only draw the required objects.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock