Answered step by step

Verified Expert Solution

Question

1 Approved Answer

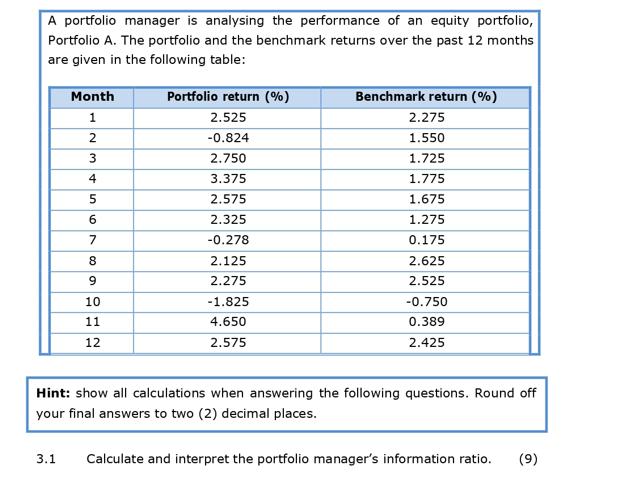

A portfolio manager is analysing the performance of an equity portfolio, Portfolio A. The portfolio and the benchmark returns over the past 12 months

A portfolio manager is analysing the performance of an equity portfolio, Portfolio A. The portfolio and the benchmark returns over the past 12 months are given in the following table: Month 1 2 3 4 5 6 7 8 9 10 11 12 Portfolio return (%) 2.525 -0.824 2.750 3.375 2.575 2.325 -0.278 2.125 2.275 -1.825 4.650 2.575 Benchmark return (%) 2.275 1.550 1.725 1.775 1.675 1.275 0.175 2.625 2.525 -0.750 0.389 2.425 Hint: show all calculations when answering the following questions. Round off your final answers to two (2) decimal places. 3.1 Calculate and interpret the portfolio manager's information ratio. (9) 3.2 A similar portfolio, Portfolio B, also uses the same benchmark as Portfolio A. The information ratio for Portfolio B is 0.15. Justify which portfoliomanager performed better.

Step by Step Solution

★★★★★

3.39 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

31 Calculate and interpret the portfolio managers information as follows Excess Portfolio ReturnPort...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started