Question: A portfolio manager is interested in constructing a portfolio using three asset classes: U.S. Stocks, U.S. Bonds, and Foreign Stocks. The research team estimates the

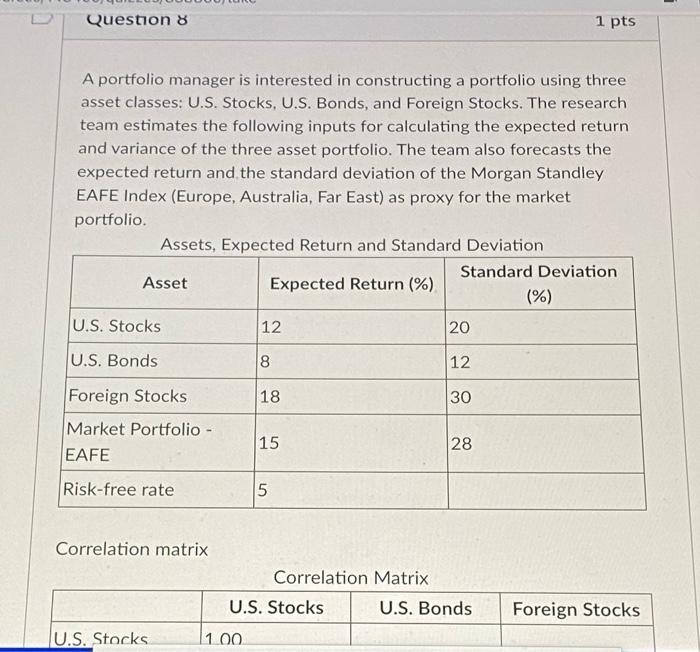

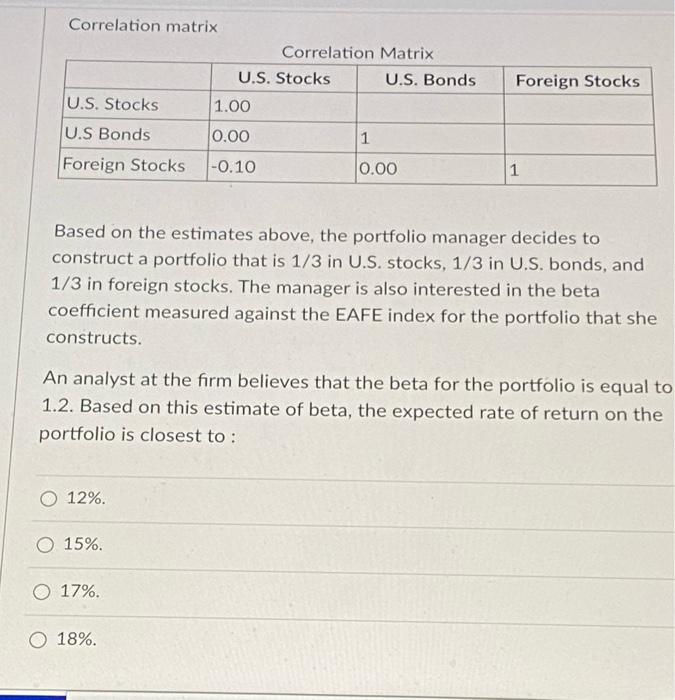

A portfolio manager is interested in constructing a portfolio using three asset classes: U.S. Stocks, U.S. Bonds, and Foreign Stocks. The research team estimates the following inputs for calculating the expected return and variance of the three asset portfolio. The team also forecasts the expected return and the standard deviation of the Morgan Standley EAFE Index (Europe, Australia, Far East) as proxy for the market portfolio. Assets. Expected Return and Standard Deviation Correlation matrix Correlation Matrix Correlation matrix Based on the estimates above, the portfolio manager decides to construct a portfolio that is 1/3 in U.S. stocks, 1/3 in U.S. bonds, and 1/3 in foreign stocks. The manager is also interested in the beta coefficient measured against the EAFE index for the portfolio that she constructs. An analyst at the firm believes that the beta for the portfolio is equal to 1.2. Based on this estimate of beta, the expected rate of return on the portfolio is closest to : 12%. 15%. 17%. 18%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts