Question: A portfolio manager owns a bond worth 3,000,000 that will mature in one year. The pound is currently worth $ 1.42, and the one-year future

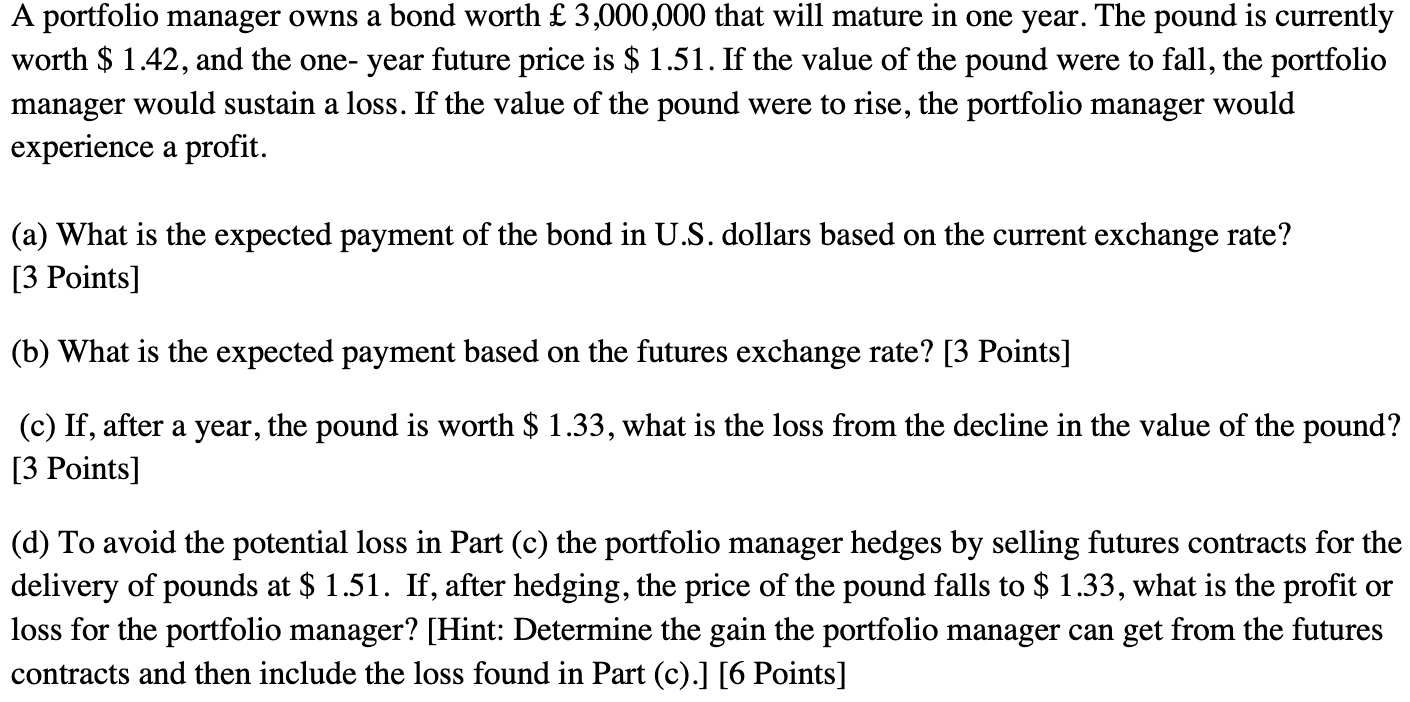

A portfolio manager owns a bond worth 3,000,000 that will mature in one year. The pound is currently worth $ 1.42, and the one-year future price is $ 1.51. If the value of the pound were to fall, the portfolio manager would sustain a loss. If the value of the pound were to rise, the portfolio manager would experience a profit. (a) What is the expected payment of the bond in U.S. dollars based on the current exchange rate? [3 Points] (b) What is the expected payment based on the futures exchange rate? [3 Points] > (c) If, after a year, the pound is worth $ 1.33, what is the loss from the decline in the value of the pound? [3 Points] (d) To avoid the potential loss in Part (c) the portfolio manager hedges by selling futures contracts for the delivery of pounds at $ 1.51. If, after hedging, the price of the pound falls to $ 1.33, what is the profit or loss for the portfolio manager? [Hint: Determine the gain the portfolio manager can get from the futures contracts and then include the loss found in Part (c).] [6 Points]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts