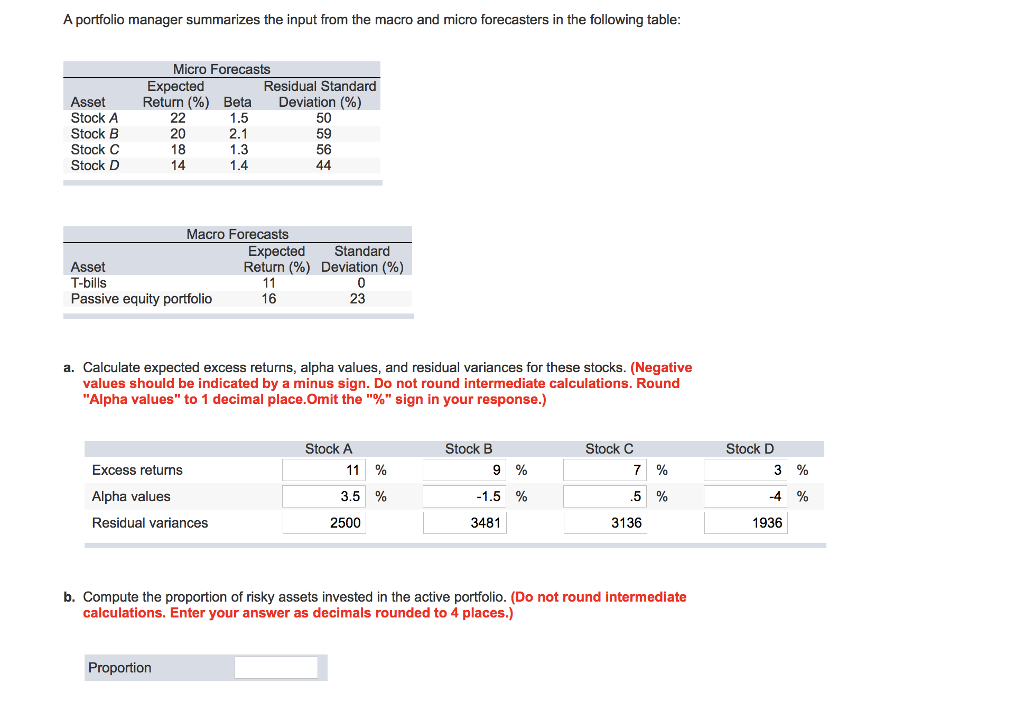

Question: A portfolio manager summarizes the input from the macro and micro forecasters in the following table Micro Forecasts Residual Standard Deviation(%) 50 59 56 Expected

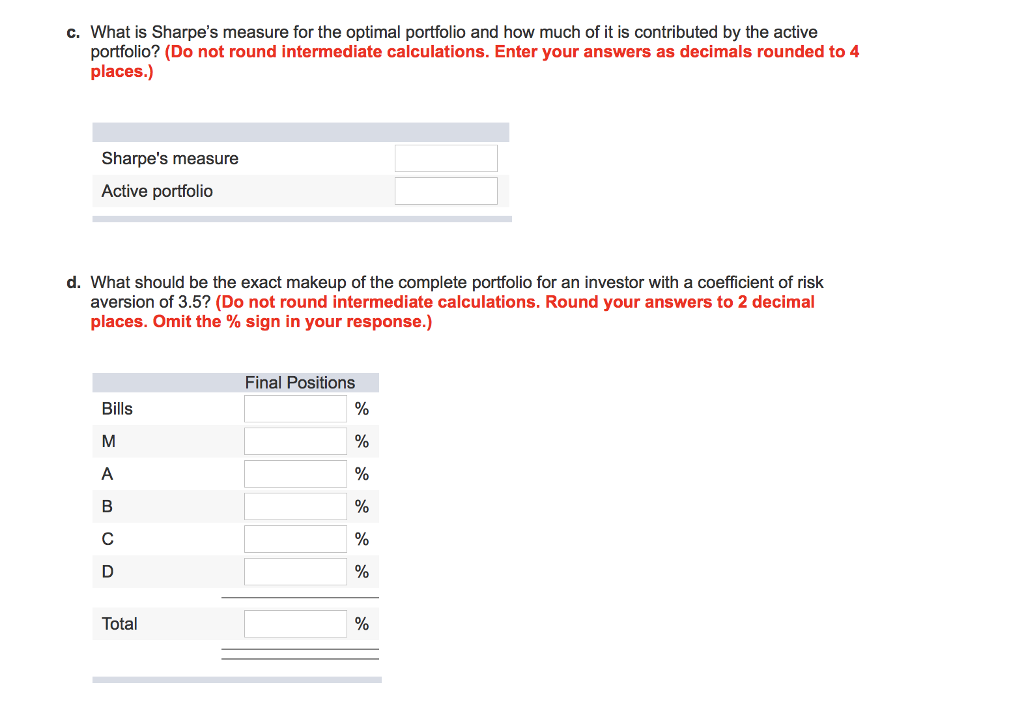

A portfolio manager summarizes the input from the macro and micro forecasters in the following table Micro Forecasts Residual Standard Deviation(%) 50 59 56 Expected Return(%) Asset Stock A Stock B Stock C Stock D Beta 1.5 20 18 14 1.3 Macro Forecasts Expected Standard Return(%) Deviation (%) Asset Passive equity portfolio 23 a. Calculate expected excess returns, alpha values, and residual variances for these stocks. (Negative values should be indicated by a minus sign. Do not round intermediate calculations. Round "Alpha values" to 1 decimal placeOmit the "%" sign in your response.) Stock A Stock B Stock C Stock D 11 % 3% Excess returns Alpha values Residual variances 3.5 % -4% 2500 3481 3136 1936 b. Compute the proportion of risky assets invested in the active portfolio. (Do not round intermediate calculations. Enter your answer as decimals rounded to 4 places.) Proportion A portfolio manager summarizes the input from the macro and micro forecasters in the following table Micro Forecasts Residual Standard Deviation(%) 50 59 56 Expected Return(%) Asset Stock A Stock B Stock C Stock D Beta 1.5 20 18 14 1.3 Macro Forecasts Expected Standard Return(%) Deviation (%) Asset Passive equity portfolio 23 a. Calculate expected excess returns, alpha values, and residual variances for these stocks. (Negative values should be indicated by a minus sign. Do not round intermediate calculations. Round "Alpha values" to 1 decimal placeOmit the "%" sign in your response.) Stock A Stock B Stock C Stock D 11 % 3% Excess returns Alpha values Residual variances 3.5 % -4% 2500 3481 3136 1936 b. Compute the proportion of risky assets invested in the active portfolio. (Do not round intermediate calculations. Enter your answer as decimals rounded to 4 places.) Proportion

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts