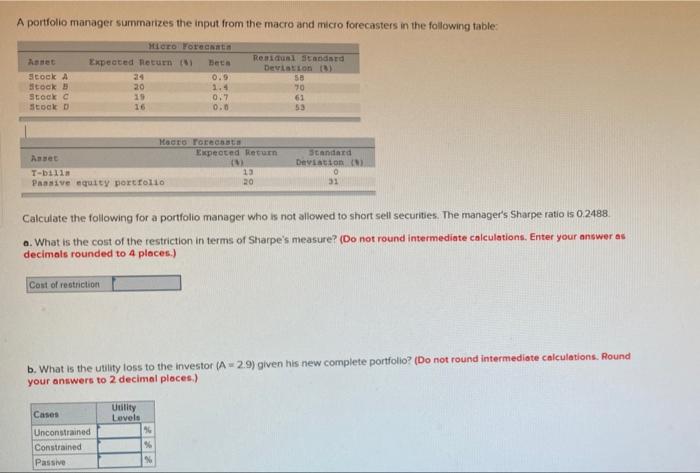

Question: A portfolio manager summarizes the input from the macro and micro forecasters in the following table: Stock Stock 5 Stock Stock Hero Toregate Expected Return

A portfolio manager summarizes the input from the macro and micro forecasters in the following table: Stock Stock 5 Stock Stock Hero Toregate Expected Return 11 Bet 24 0.9 20 1.4 15 0.7 16 0.0 Residumi standard Deviation (3) SB 90 61 Macro Forecast Expected Return Asset T-bis 13 Paasive equity portfolio 20 Standard Deviation 31 Calculate the following for a portfolio manager who is not allowed to short sell securities. The manager's Sharpe ratio is 02488 o. What is the cost of the restriction in terms of Sharpe's measure? (Do not round intermediate calculations. Enter your answer as decimals rounded to 4 places.) Cont of restriction b. What is the utility loss to the investor ( A29) given his new complete portfolio? (Do not round intermediate calculations. Round your answers to 2 decimal places.) Utility Levels Cases Unconstrained Constrained Passive 3

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts