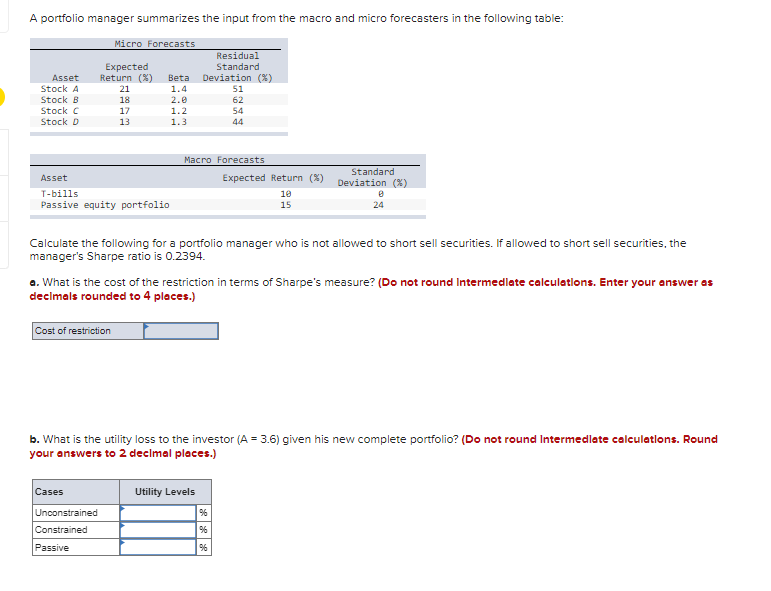

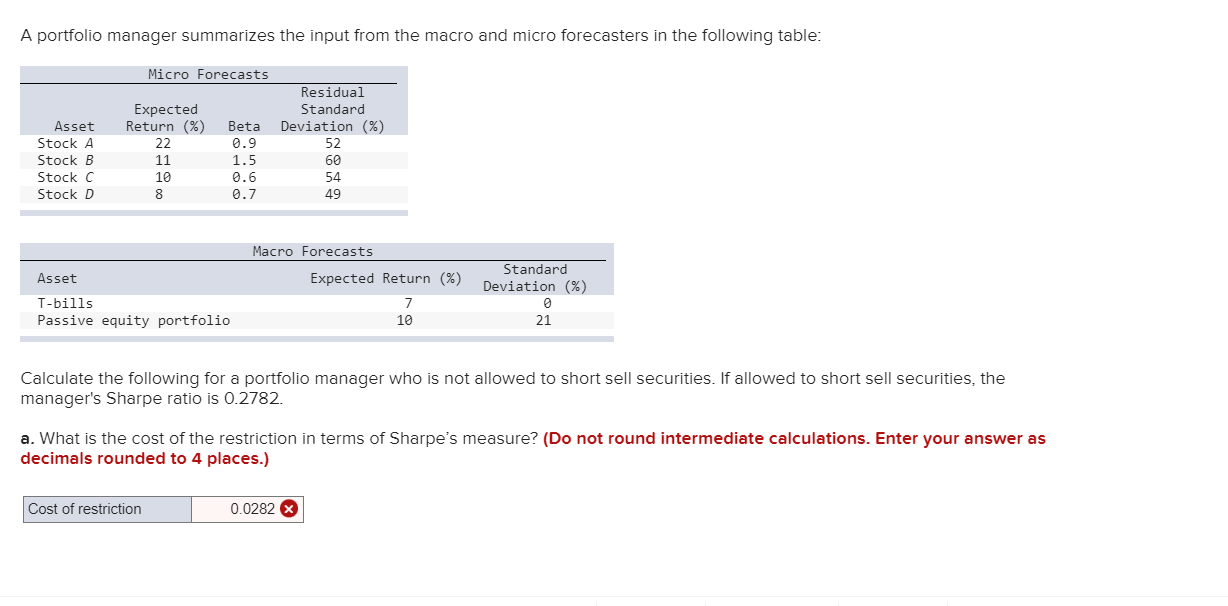

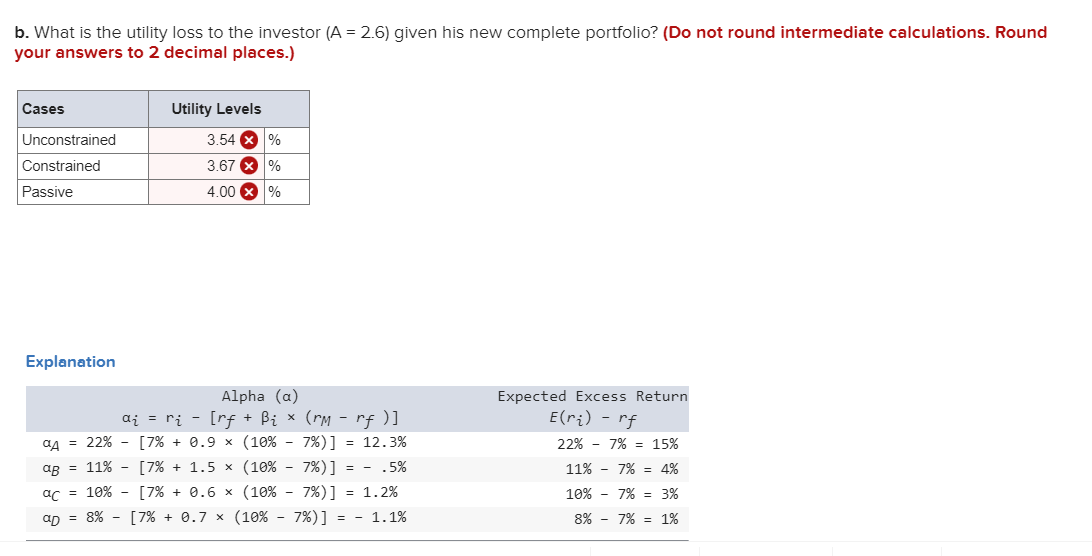

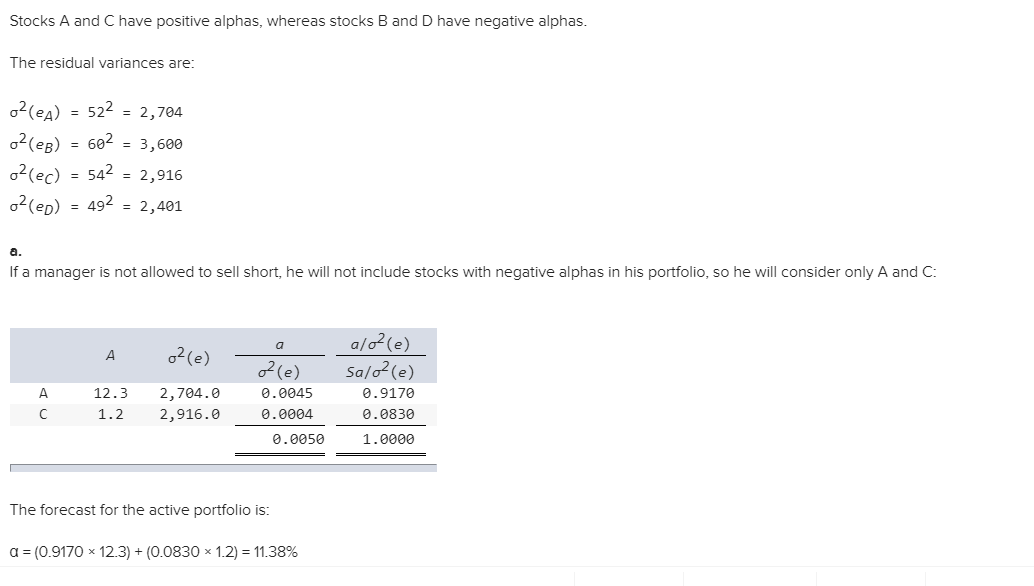

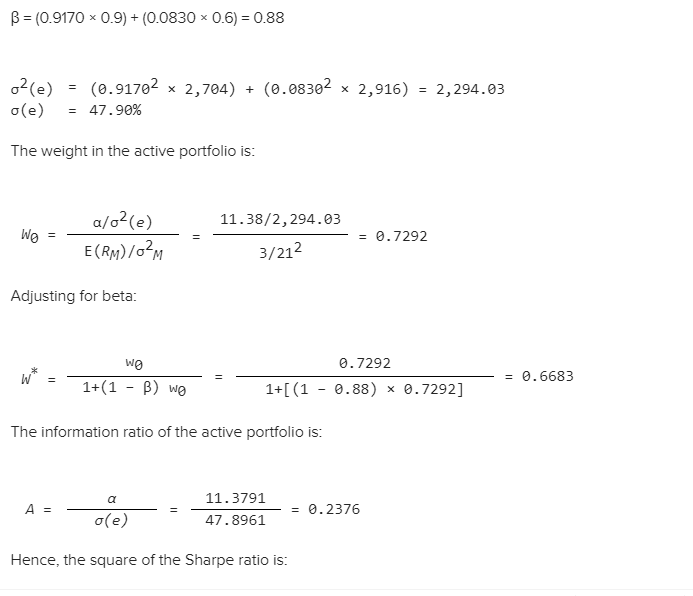

Question: A portfolio manager summarizes the input from the macro and micro forecasters in the following table: Micro Forecasts Residual Expected Standard Asset Return (8) Beta

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts