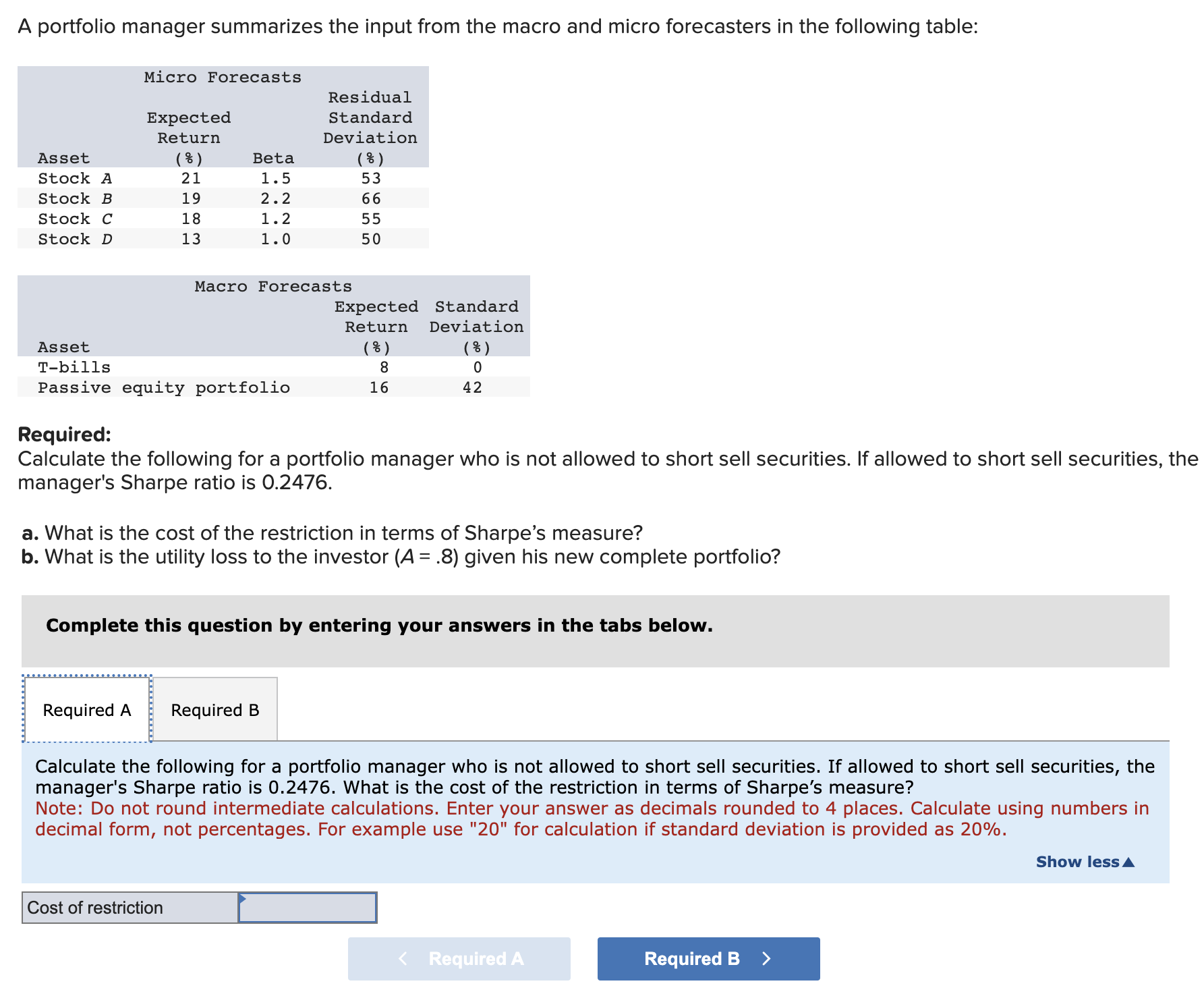

Question: A portfolio manager summarizes the input from the macro and micro forecasters in the following table: Required: Calculate the following for a portfolio manager who

A portfolio manager summarizes the input from the macro and micro forecasters in the following table: Required: Calculate the following for a portfolio manager who is not allowed to short sell securities. If allowed to short sell securities, th manager's Sharpe ratio is 0.2476 . a. What is the cost of the restriction in terms of Sharpe's measure? b. What is the utility loss to the investor (A=.8) given his new complete portfolio? Complete this question by entering your answers in the tabs below. Calculate the following for a portfolio manager who is not allowed to short sell securities. If allowed to short sell securities, the manager's Sharpe ratio is 0.2476 . What is the cost of the restriction in terms of Sharpe's measure? Note: Do not round intermediate calculations. Enter your answer as decimals rounded to 4 places. Calculate using numbers in decimal form, not percentages. For example use "20" for calculation if standard deviation is provided as 20%. A portfolio manager summarizes the input from the macro and micro forecasters in the following table: Required: Calculate the following for a portfolio manager who is not allowed to short sell securities. If allowed to short sell securities, th manager's Sharpe ratio is 0.2476 . a. What is the cost of the restriction in terms of Sharpe's measure? b. What is the utility loss to the investor (A=.8) given his new complete portfolio? Complete this question by entering your answers in the tabs below. Calculate the following for a portfolio manager who is not allowed to short sell securities. If allowed to short sell securities, the manager's Sharpe ratio is 0.2476 . What is the cost of the restriction in terms of Sharpe's measure? Note: Do not round intermediate calculations. Enter your answer as decimals rounded to 4 places. Calculate using numbers in decimal form, not percentages. For example use "20" for calculation if standard deviation is provided as 20%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts