Question: MFL For problems in this section, you should download the KMS spreadsheets available on the book's Web site. 12. Assume that KMS's market share will

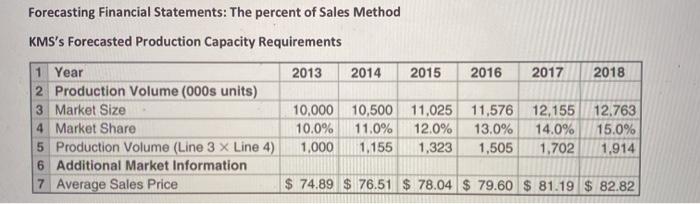

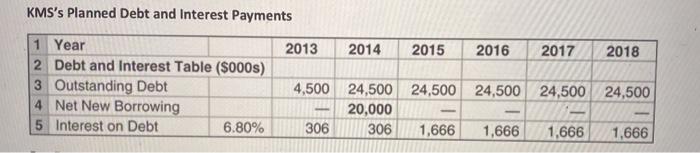

MFL For problems in this section, you should download the KMS spreadsheets available on the book's Web site. 12. Assume that KMS's market share will increase by 0.25% per year rather than the 1% used in the chapter (see Table 18.5) and that its prices remain as in the chapter. What production capacity will KMS require each year? When will an expansion become necessary (that is, when will production volume exceed 1100)? 13. Under the assumption that KMS's market share will increase by 0.25% per year, you determine that the plant will require an expansion in 2015. The expansion will cost $20 million. Assuming that the financing of the expansion will be delayed accordingly, calculate the projected interest payments and the amount of the projected interest tax shields (assuming that KMS still uses a 10-year bond and interest rates remain the same as in the chapter) through 2018. MFE Forecasting Financial Statements: The percent of Sales Method KMS's Forecasted Production Capacity Requirements 2013 2014 2015 2016 2017 2018 1 Year 2 Production Volume (000s units) 3 Market Size 4 Market Share 5 Production Volume (Line 3 x Line 4) 6 Additional Market Information 7 Average Sales Price 10,000 10,500 11,025 11,576 12.155 10.0% 11.0% 12.0% 13.0% 14.0% 1,000 1,155 1,323 1,505 1,702 12,763 15.0% 1,914 $ 74.89 $ 76.51 $ 78.04 $ 79.60 $ 81.19 $ 82.82 KMS's Planned Debt and Interest Payments 2013 2014 2015 2016 2017 2018 1 Year 2 Debt and Interest Table (5000s) 3 Outstanding Debt 4 Net New Borrowing 5 Interest on Debt 6.80% 24,500 24,500 4,500 24,500 24,500 24,500 20,000 306 306 1,666 1,666 1,666 1,666

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts