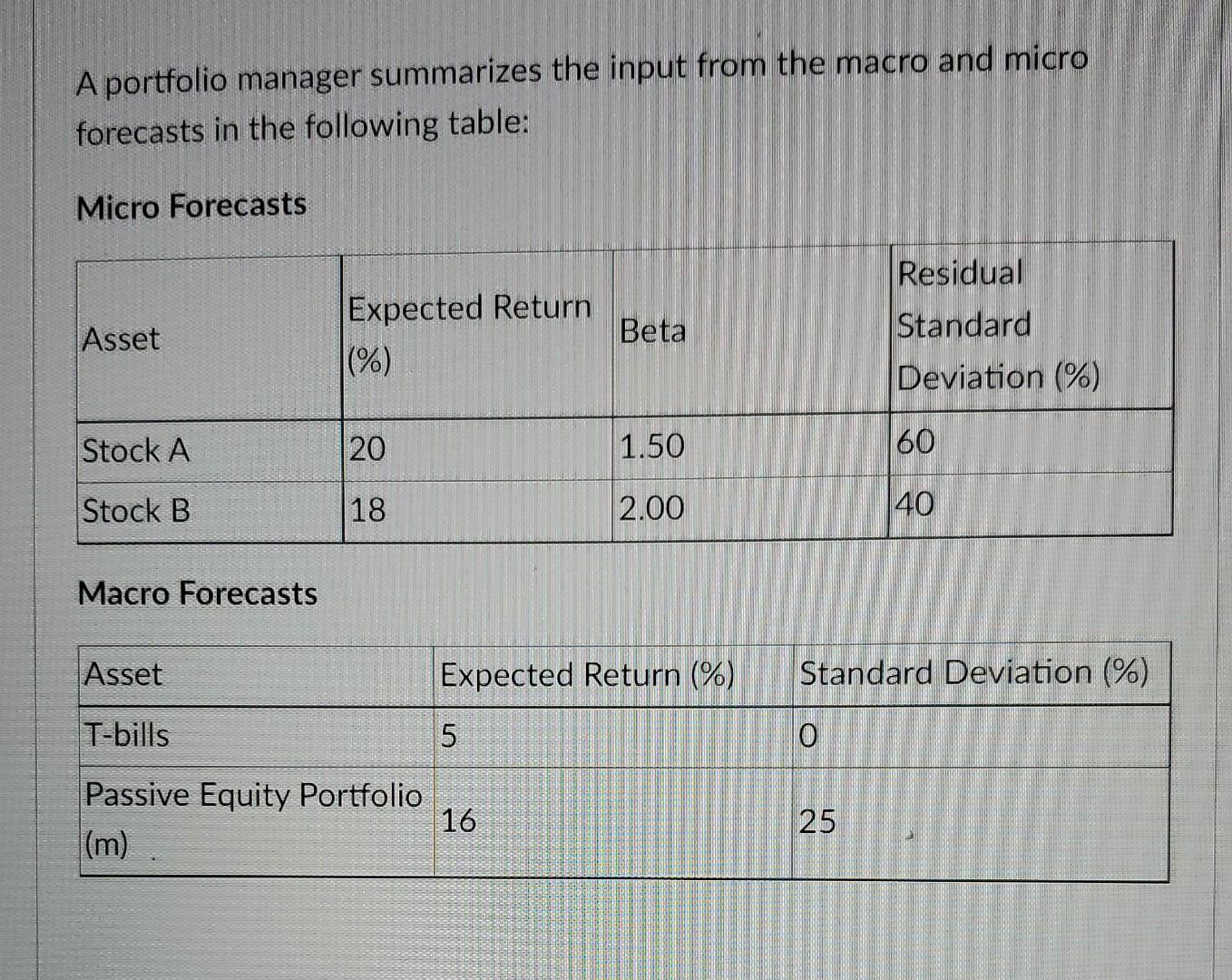

Question: A portfolio manager summarizes the input from the macro and micro forecasts in the following table: Micro Forecasts Expected Return |(%) Asset Residual Standard Deviation

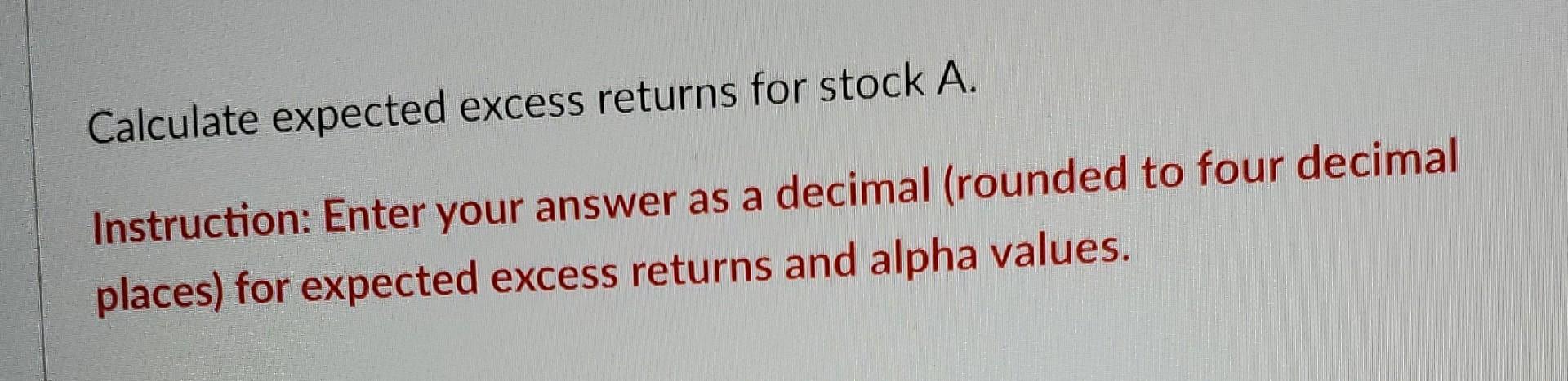

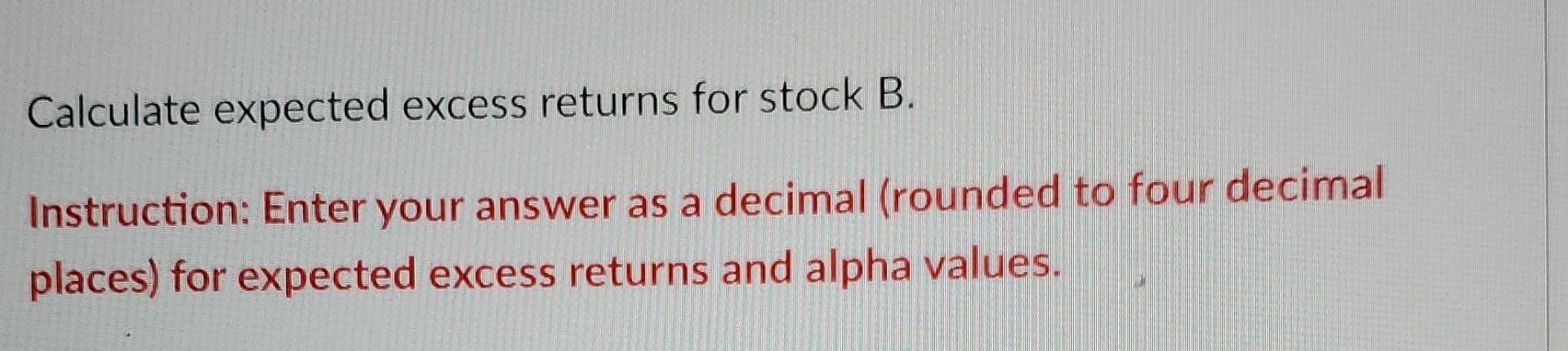

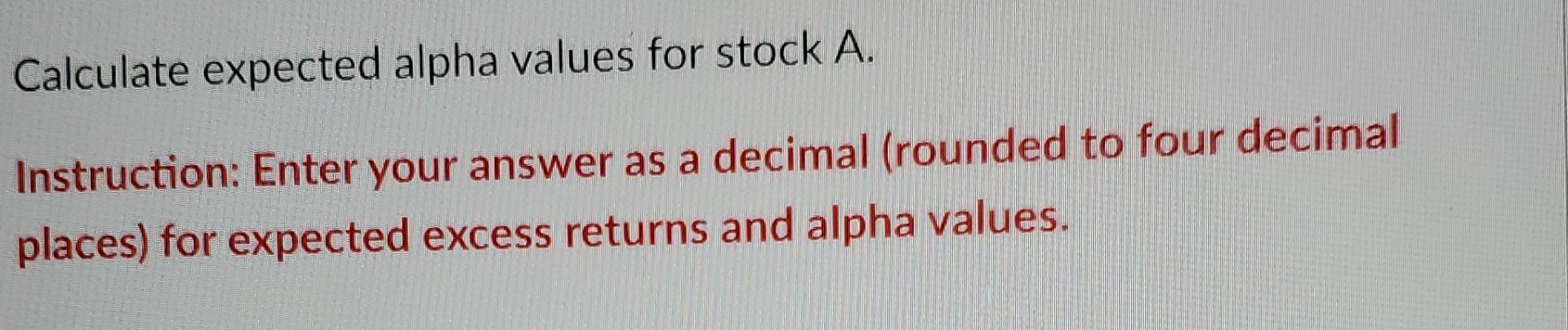

A portfolio manager summarizes the input from the macro and micro forecasts in the following table: Micro Forecasts Expected Return |(%) Asset Residual Standard Deviation (%) Beta Stock A 20 1.50 60 Stock B 18 2.00 40 Macro Forecasts Asset Expected Return (%) Standard Deviation (%) T-bills 5 O Passive Equity Portfolio (m) 16 25 Calculate expected excess returns for stock A. Instruction: Enter your answer as a decimal (rounded to four decimal places) for expected excess returns and alpha values. Calculate expected excess returns for stock B. Instruction: Enter your answer as a decimal (rounded to four decimal places) for expected excess returns and alpha values. Calculate expected alpha values for stock A. Instruction: Enter your answer as a decimal (rounded to four decimal places) for expected excess returns and alpha values. Calculate expected alpha values for stock B. Instruction: Enter your answer as a decimal (rounded to four decimal places) for expected excess returns and alpha values. Calculate expected residual variances for stock A. Instruction: Enter your answer as a decimal (rounded to two decimal places) for expected excess returns and alpha values. Calculate expected residual variances for stock B. Instruction: Enter your answer as a decimal (rounded to two decimal places) for expected excess returns and alpha values

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts