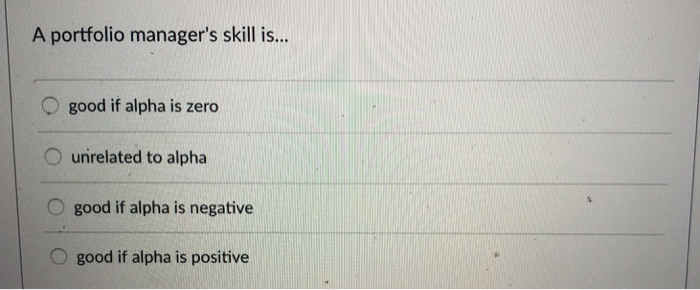

Question: A portfolio manager's skill is... O good if alpha is zero O unrelated to alpha O good if alpha is negative O good if alpha

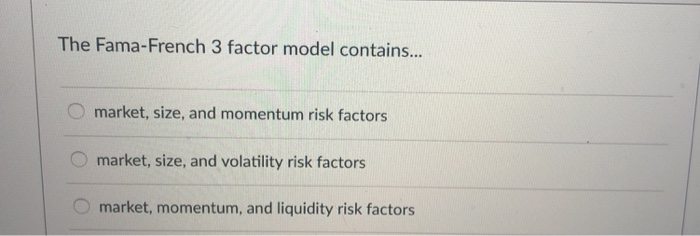

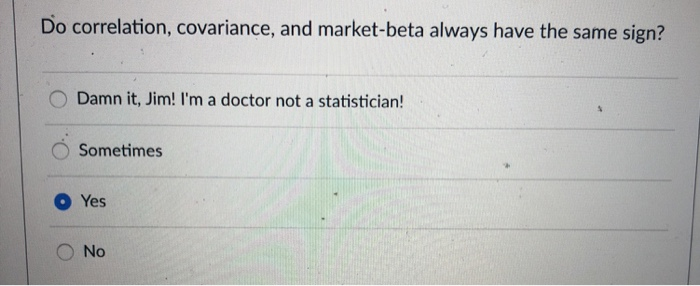

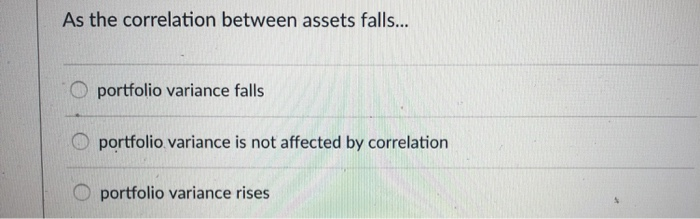

A portfolio manager's skill is... O good if alpha is zero O unrelated to alpha O good if alpha is negative O good if alpha is positive The Fama-French 3 factor model contains... O market, size, and momentum risk factors O market, size, and volatility risk factors O market, momentum, and liquidity risk factors Do correlation, covariance, and market-beta always have the same sign? O Damn it, Jim! I'm a doctor not a statistician! Sometimes Yes O No As the correlation between assets falls... O portfolio variance falls portfolio variance is not affected by correlation O portfolio variance rises

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock