Question: A powerplant initial cost IC = $3, 300,000, A = $400,000 per year for 25 years, Salvage value at end S = $700,000. Simple payback

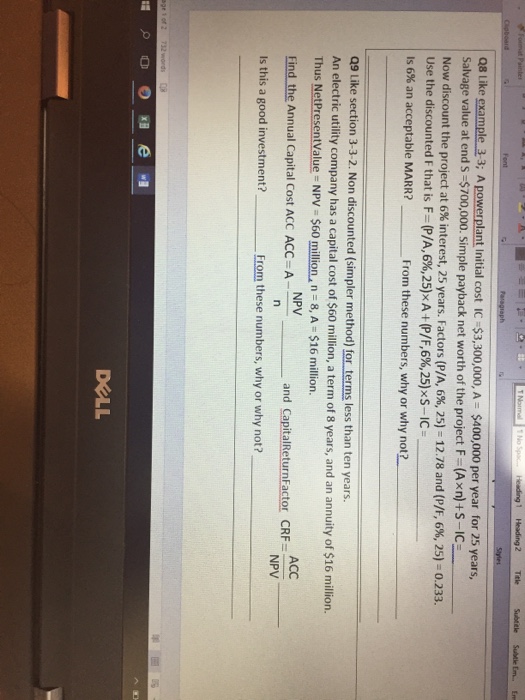

A powerplant initial cost IC = $3, 300,000, A = $400,000 per year for 25 years, Salvage value at end S = $700,000. Simple payback net worth of the project F = (A times n) + S - IC = _____ Now discount the project at 6% interest, 25 years. Factors (P/A, 6%, 25) = 12.78 and (P/F, 6%, 25) = 0.233. Use the discounted F that is F = (P/A, 6%, 25) times A + (P/F, 6%, 25) times S - IC = _____ is 6% an acceptable MARR? _____ From these numbers, why or why not? _____ Like section 3-3-2. Non discounted (simpler method) for terms less than ten years. An electric utility company has a capital cost of $60 million, a term of 8 years, and an annuity of $16 million. Thus NetPresentvalue = NPV = $60 million, n = 8, A = $16 million. Find the Annual Capital Cost ACC ACC = A - NPV _____ and CapitalReturnFactor CRF = ACC/NPV Is this a good investment? _____ From these numbers, why or why not? _____

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts