Question: a) Prepare a tabular summary that includes the property, plant, and equipment balances as of January 1, 2027. b) Record the above transactions in the

a) Prepare a tabular summary that includes the property, plant, and equipment balances as of January 1, 2027.

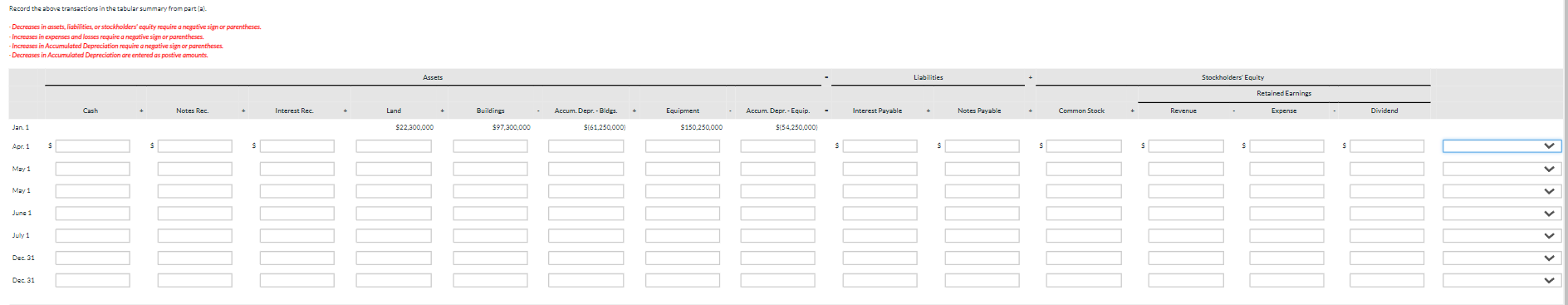

b) Record the above transactions in the tabular summary from part (a).

c) Record any adjustments required at December 31.

d) Prepare the property, plant, and equipment section of the companys balance sheet at December 31.

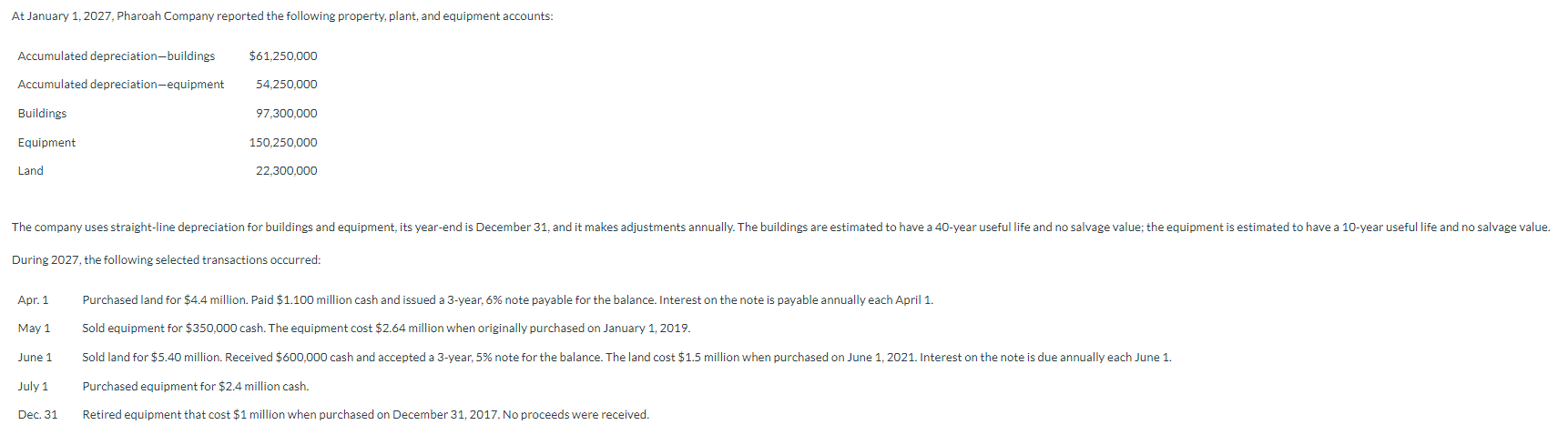

At January 1, 2027, Pharoah Company reported the following property, plant, and equipment accounts: During 2027, the following selected transactions occurred: Apr. 1 Purchased land for $4.4 million. Paid $1.100 million cash and issued a 3-year, 6% note payable for the balance. Interest on the note is payable annually each April 1. May 1 Sold equipment for $350,000 cash. The equipment cost $2.64 million when originally purchased on January 1,2019. July 1 Purchased equipment for $2.4 million cash. Dec. 31 Retired equipment that cost $1 million when purchased on December 31, 2017. No proceeds were received. Record the abova transactions in the tabular summary from part (a). - Decreases in assets, liabilities, or stockholders' equity require a negative sign or parentheses. - Increases in expenses and losses require a negative sign or parentheses. - Increases in Accumulated Depreciation require a negative sign or parentheses. - Decreases in Accumulated Depreciation are entered as postive amounts

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts