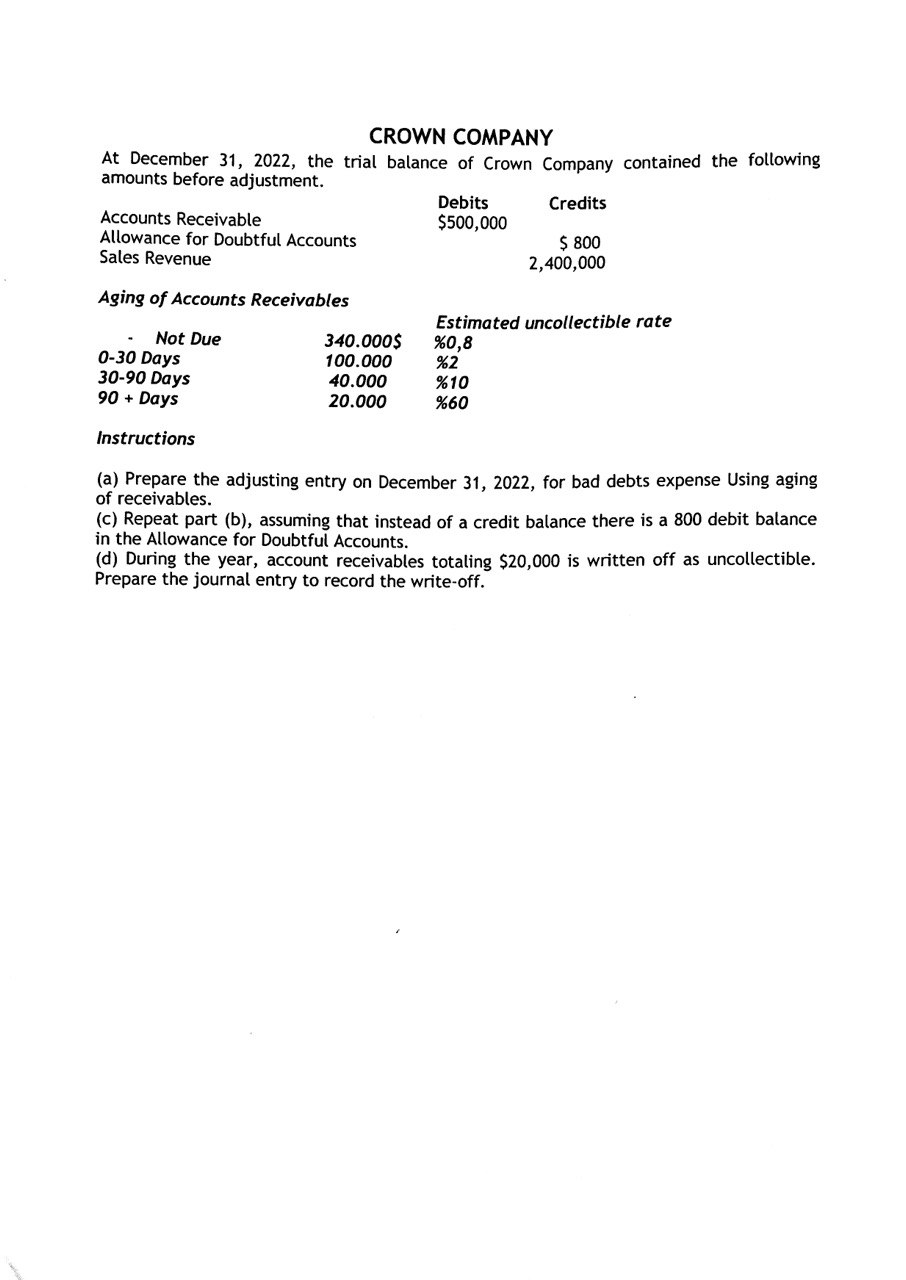

Question: ( a ) Prepare the adjusting entry on December 3 1 , 2 0 2 2 , for bad debts expense Using aging of receivables.

a Prepare the adjusting entry on December for bad debts expense Using aging

of receivables.

c Repeat part b assuming that instead of a credit balance there is a debit balance

in the Allowance for Doubtful Accounts.

d During the year, account receivables totaling $ is written off as uncollectible.

Prepare the journal entry to record the writeoff.CROWN COMPANY

At December the trial balance of Crown Company contained the following

amounts before adjustment.

Accounts Receivable

Allowance for Doubtful Accounts

Sales Revenue

Aging of Accounts Receivables

Debits Credits

$$

Instructions

a Prepare the adjusting entry on December for bad debts expense Using aging

of receivables.

c Repeat part b assuming that instead of a credit balance there is a debit balance

in the Allowance for Doubtful Accounts.

d During the year, account receivables totaling $ is written off as uncollectible.

Prepare the journal entry to record the writeoff.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock