Question: i need the answer fast please Current Attempt in Progress Adam S, managing director of Summer Breeze, a swimsuit manufacturing company, has requested you to

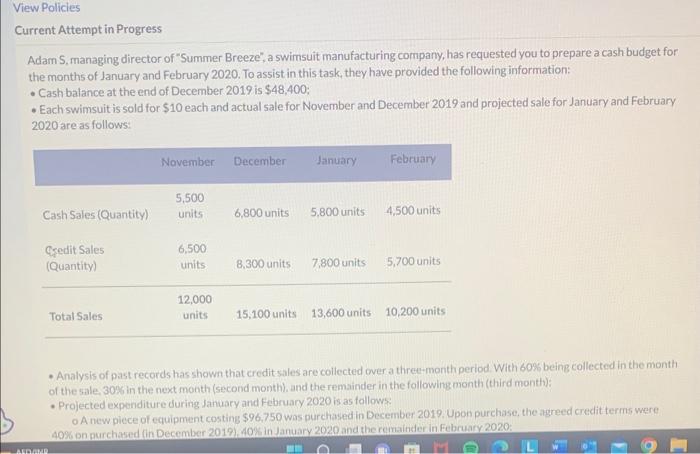

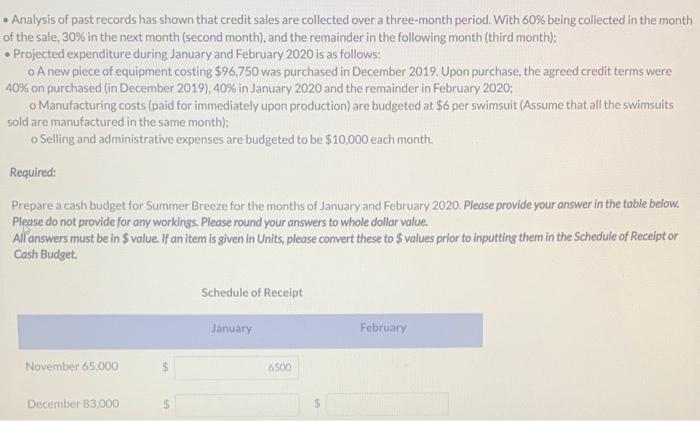

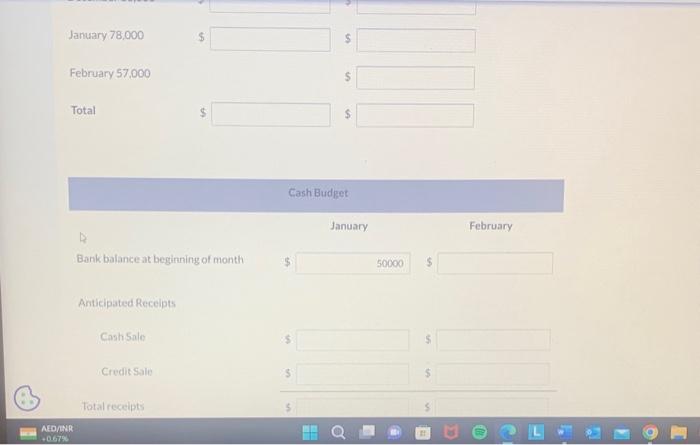

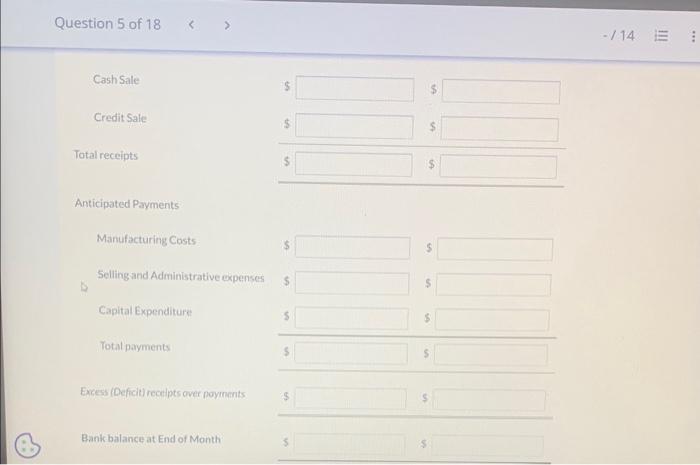

Current Attempt in Progress Adam S, managing director of "Summer Breeze", a swimsuit manufacturing company, has requested you to prepare a cash budget for the months of January and February 2020. To assist in this task, they have provided the following information: - Cash balance at the end of December 2019 is $48,400; - Each swimsuit is sold for $10 each and actual sale for November and December 2019 and projected sale for January and February 2020 are as follows: - Analysis of past records has shown that credit sales are collected over a three-month period With 605 being collected in the month. of the sale. 30% in the next month (second month). and the remainder in the following month (third month): - Projected expenditure during January and February 2020 is as followe: o A new piece of equipment costing $96,750 was purchased in December 2019. Upon purchase, the agreed credit terms were 40\% on nurchased (in December 2019), 40% in January 2020 and the remainder in February 2020 : - Analysis of past records has shown that credit sales are collected over a three-month period. With 60% being collected in the month of the sale, 30% in the next month (second month), and the remainder in the following month (third month); - Projected expenditure during January and February 2020 is as follows: o A new piece of equipment costing $96,750 was purchased in December 2019. Upon purchase, the agreed credit terms were 40% on purchased (in December 2019), 40\% in January 2020 and the remainder in February 2020; o Manufacturing costs (paid for immediately upon production) are budgeted at $6 per swimsuit (Assume that all the swimsuits sold are manufactured in the same month): o Selling and administrative expenses are budgeted to be $10,000 each month. Required: Prepare a cash budget for Summer Breeze for the months of January and February 2020 . Please provide your answer in the table below. Please do not provide for any workings. Please round your answers to whole dollar value. All answers must be in $ value. If an item is given in Units, please convert these to $ values prior to inputting them in the Schedule of Receipt or Cosh Budget. Schedule of Receipt January 78,000 February 57,000 Total Anticipated Receipts Question 5 of 18 \begin{tabular}{|c|c|} CashSale & 3 \end{tabular} Anticipated Payments Manufacturing Costs Sellingand Administrative expenses

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts