Question: a. Present the Capital Asset Pricing Model (CAPM). Discuss how the model is made operational when it comes to estimating it using the data. b.

a. Present the Capital Asset Pricing Model (CAPM). Discuss how the model is made operational when it comes to estimating it using the data.

Present the Capital Asset Pricing Model (CAPM). Discuss how the model is made operational when it comes to estimating it using the data.

b. Estimate the simple CAPM model. Report and discuss the results and whether you believe the estimate you have obtained is appropriate. Test the hypothesis that the asset is in equilibrium. Discuss the testing procedure, report the result of the test, and discuss the decision you take.

c. Assume that you hold a portfolio. Would you buy this asset if your aim is to make the portfolio you hold risk neutral? Discuss.

d. Present and discuss the Fama and French (1993) three factors model. Estimate it using the data and discuss the results. Compare the results with those from the model under question (b). What is the preferred model, and why? e. Discuss the relationship, if any, among the models you have estimated in question (b) and (d) and the single and the multiple index models.

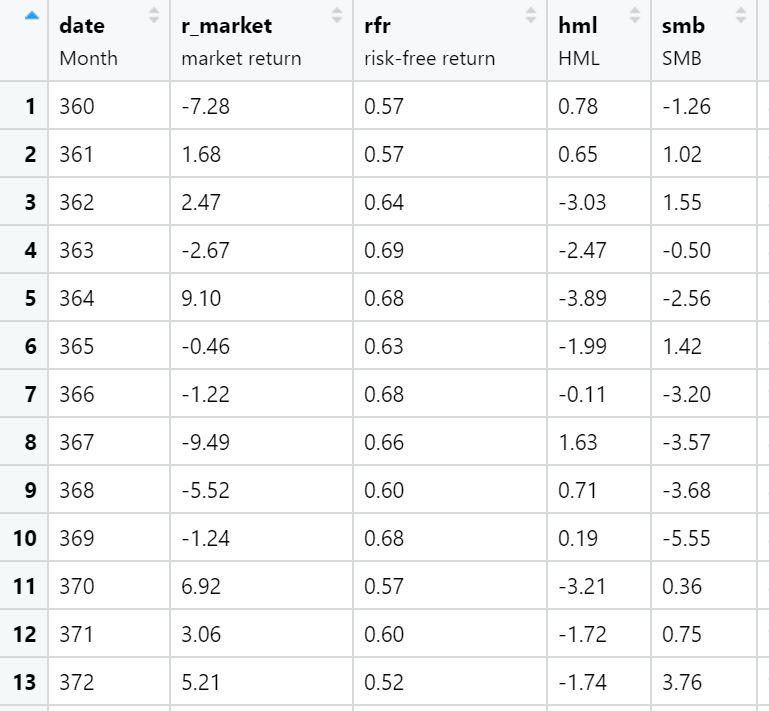

smb date Month r_market market return rfr risk-free return hml HML SMB 1 360 -7.28 0.57 0.78 -1.26 2 361 1.68 0.57 0.65 1.02 3 362 2.47 0.64 -3.03 1.55 4 363 -2.67 0.69 -2.47 -0.50 5 364 9.10 0.68 -3.89 -2.56 6 365 -0.46 0.63 -1.99 1.42 7 366 - 1.22 0.68 -0.11 -3.20 8 367 -9.49 0.66 1.63 -3.57 9368 -5.52 0.60 0.71 -3.68 10 369 - 1.24 0.68 0.19 -5.55 11 370 6.92 0.57 -3.21 0.36 12 371 3.06 0.60 -1.72 0.75 13 372 5.21 0.52 -1.74 3.76 smb date Month r_market market return rfr risk-free return hml HML SMB 1 360 -7.28 0.57 0.78 -1.26 2 361 1.68 0.57 0.65 1.02 3 362 2.47 0.64 -3.03 1.55 4 363 -2.67 0.69 -2.47 -0.50 5 364 9.10 0.68 -3.89 -2.56 6 365 -0.46 0.63 -1.99 1.42 7 366 - 1.22 0.68 -0.11 -3.20 8 367 -9.49 0.66 1.63 -3.57 9368 -5.52 0.60 0.71 -3.68 10 369 - 1.24 0.68 0.19 -5.55 11 370 6.92 0.57 -3.21 0.36 12 371 3.06 0.60 -1.72 0.75 13 372 5.21 0.52 -1.74 3.76

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts