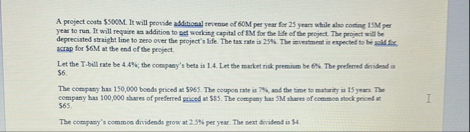

Question: A project coats $ 5 0 0 M . It will peovide additional sevenve of 6 0 M per year for 2 5 yearn while

A project coats $ It will peovide additional sevenve of M per year for yearn while also corting M per year to run. It will requise as addition to pet working capital of SM for the Me of the projnct. The peoject will be depreciated straight line to zero over the project's life. The tex rate is The invertment in erpected to be aciffir. yarap for M at the end of the project.

Let the Tbill rate be ; the company's beta is Let the market risk peemimm be The preferes deridend is $

The compary has bonds priced as $ The coupos rate is and the time to matarity in yearn. The company has nhares of preferved genced an $ The compary han M shares of coemmos stock pricod ac $

The compasy's commoe dividends grow at per year. The sext dividend is $

What is the depreciation per year?

What is the OCF per gear?

What is the present value of the OCF?

What is the present value of ATSV?

What is the present value of all changes in net working capital?

What is the present value of net capital spending?

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock