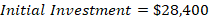

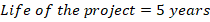

Question: A project has the following estimated data: Ignoring the effect of the taxes and using straight line depreciation method, what is the accounting break-even quantity?

A project has the following estimated data:

- Ignoring the effect of the taxes and using straight line depreciation method, what is the accounting break-even quantity?

- Ignoring the effect of the taxes, what is the cash break-even quantity?

- Ignoring the effect of the taxes, what is the financial break-even quantity?

- What is the degree of operating leverage?

- If sales decrease by 10%, how much will the operating cash flow be?

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock