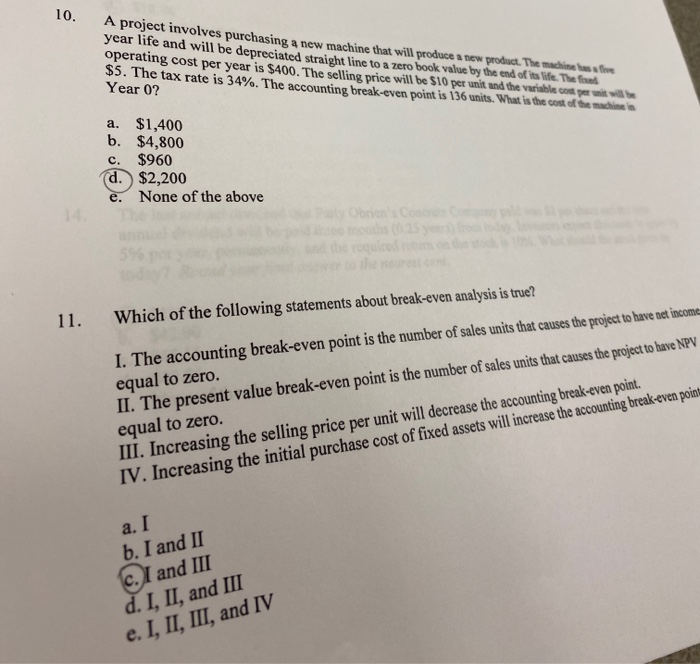

Question: A project involves purchasing a new machine that will produce a new product. The main ass fue year life and will be depreciated straight line

A project involves purchasing a new machine that will produce a new product. The main ass fue year life and will be depreciated straight line to a zero book value by the end of its life. The operating cost per year is $400. The selling price will be $10 per unit and the variable one will be . The tax rate is 34%. The accounting break-even point is 136 units. What is the cost of the Year 0? a. $1,400 b. $4,800 c. $960 (d. $2,200 e. None of the above 11. Which of the following statements about break-even analysis is true? I. The accounting break-even point is the number of sales units that causes the project to have net income equal to zero. II. The present value break-even point is the number of sales units that causes the project to bave NPV equal to zero. III. Increasing the selling price per unit will decrease the accounting break-even point. IV. Increasing the initial purchase cost of fixed assets will increase the accounting break-even point a. I b. I and II c. I and III d. I, II, and III e. I, II, III, and IV

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts