Question: QUESTION 7 A 5-year project involves purchasing a new machine in Year that will produce a new product. The machine has a five year life

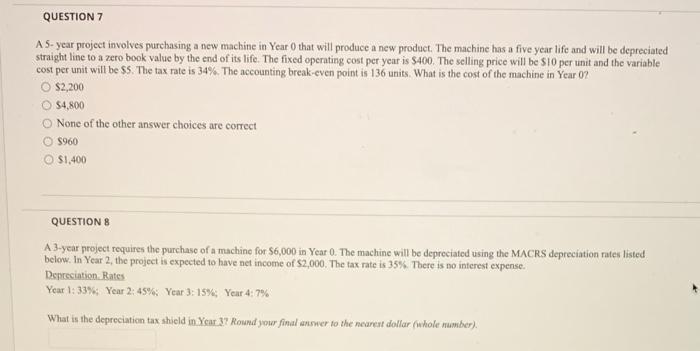

QUESTION 7 A 5-year project involves purchasing a new machine in Year that will produce a new product. The machine has a five year life and will be depreciated straight line to a zero book value by the end of its life. The fixed operating cost per year is $400. The selling price will be $10 per unit and the variable cost per unit will be $5. The tax rate is 34%. The accounting break-even point is 136 units. What is the cost of the machine in Year 07 $2,200 $4,800 None of the other answer choices are correct 5960 $1,400 QUESTIONS A 3-year project requires the purchase of a machine for $6,000 in Year 0. The machine will be depreciated using the MACRS depreciation rates listed below. In Year 2, the project is expected to have net income of $2,000. The tax rate is 35%. There is no interest expense. Depreciation Rates Year 1: 33% Year 2: 45% Year 3:15% Year 4: 7% What is the depreciation tax shield in Year 37 Round your final wer to the nearest dollar (whole number)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts