Question: A project is expected to create operating cash flows of $20,000 per year for three years. The initial cost of the fixed assets is $50,000.

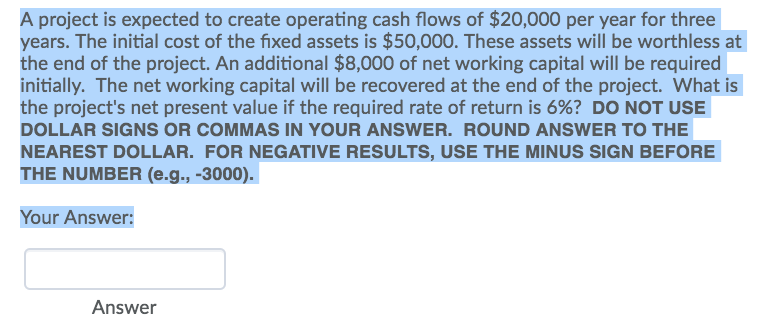

A project is expected to create operating cash flows of $20,000 per year for three years. The initial cost of the fixed assets is $50,000. These assets will be worthless at the end of the project. An additional $8,000 of net working capital will be required initially. The net working capital will be recovered at the end of the project. What is the project's net present value if the required rate of return is 6967 DO NOT USE DOLLAR SIGNS OR COMMAS IN YOUR ANSWER. ROUND ANSWER TO THE NEAREST DOLLAR. FOR NEGATIVE RESULTS, USE THE MINUS SIGN BEFORE THE NUMBER (e.g., -3000). Your

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock