Question: A project manager is using the payback method to make the final decision on which project to undertake. The company has a 12% required rate

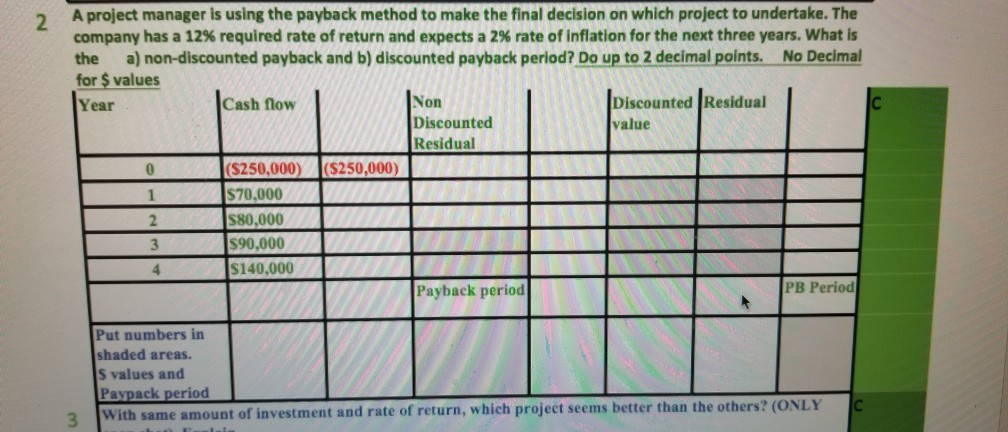

A project manager is using the payback method to make the final decision on which project to undertake. The company has a 12% required rate of return and expects a 2% rate of inflation for the next three years. What is the a) non-discounted payback and b) discounted payback period? Do up to 2 decimal points. No Decimal for $ values Year Cash flow Non Discounted Residual Discounted value Residual ($250,000) ($250,000) 1 $70,000 2 580,000 3 $90,000 IUDITT 4 $140,000 Payback period PB Period X / X Put numbers in TA shaded areas. S values and Paypack period With same amount of investment and rate of return, which project seems better than the others? (ONLY

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts