Question: A project needs to be turned in soon. This is EMERGENCY! PLEASE HELP! Theodosis Theodosiou, a civil engineer, relocated from the United Arab Emirates to

A project needs to be turned in soon. This is EMERGENCY! PLEASE HELP!

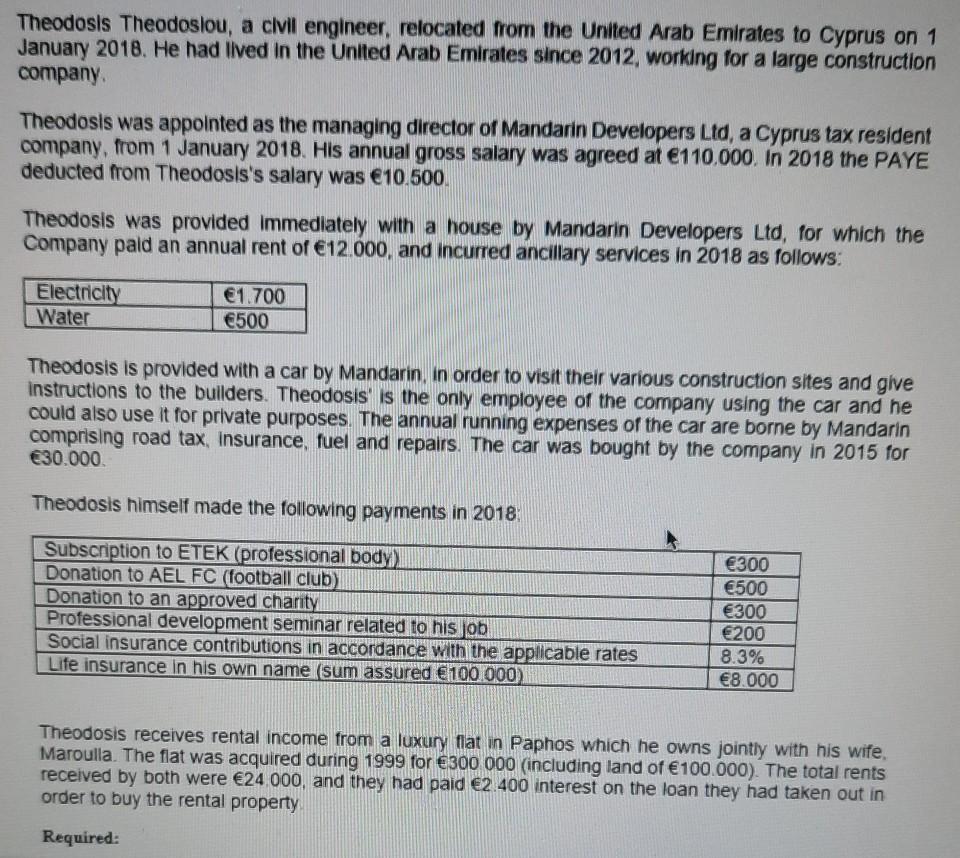

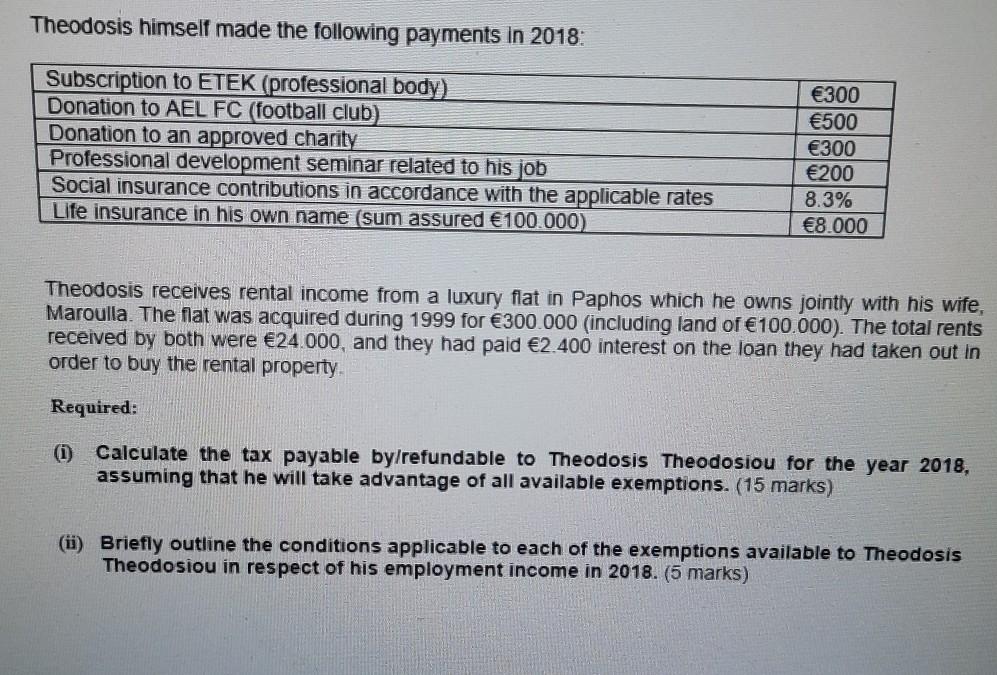

Theodosis Theodosiou, a civil engineer, relocated from the United Arab Emirates to Cyprus on 1 January 2018. He had lived in the United Arab Emirates since 2012, working for a large construction company Theodosis was appointed as the managing director of Mandarin Developers Ltd, a Cyprus tax resident company, from 1 January 2018. His annual gross salary was agreed at 110.000. In 2018 the PAYE deducted from Theodosis's salary was 10.500. Theodosis was provided immediately with a house by Mandarin Developers Ltd, for which the Company pald an annual rent of 12.000, and incurred ancillary services in 2018 as follows: Electricity Water 1.700 500 Theodosis is provided with a car by Mandarin, in order to visit their various construction sites and give Instructions to the builders. Theodosis' is the only employee of the company using the car and he could also use it for private purposes. The annual running expenses of the car are borne by Mandarin comprising road tax, insurance, fuel and repairs. The car was bought by the company in 2015 for 30.000 Theodosis himself made the following payments in 2018 Subscription to ETEK (professional body) Donation to AEL FC (football club) Donation to an approved charity Professional development seminar related to his job Social insurance contributions in accordance with the applicable rates Life insurance in his own name sum assured 100.000) 300 500 300 200 8.3% 8.000 Theodosis receives rental income from a luxury flat in Paphos which he owns jointly with his wife, Maroulla. The flat was acquired during 1999 for 300 000 (including land of 100.000). The total rents received by both were 24 000, and they had paid 2 400 interest on the loan they had taken out in order to buy the rental property Required: Theodosis himself made the following payments in 2018: Subscription to ETEK (professional body) Donation to AEL FC (football club) Donation to an approved charity Professional development seminar related to his job Social insurance contributions in accordance with the applicable rates Life insurance in his own name (sum assured 100.000) 300 500 300 200 8.3% 8.000 Theodosis receives rental income from a luxury flat in Paphos which he owns jointly with his wife, Maroulla. The flat was acquired during 1999 for 300.000 (including land of 100.000). The total rents received by both were 24.000, and they had paid 2.400 interest on the loan they had taken out in order to buy the rental property Required: (1) Calculate the tax payable by/refundable to Theodosis Theodosiou for the year 2018, assuming that he will take advantage of all available exemptions. (15 marks) (ii) Briefly outline the conditions applicable to each of the exemptions available to Theodosis Theodosiou in respect of his employment income in 2018. (5 marks) Theodosis Theodosiou, a civil engineer, relocated from the United Arab Emirates to Cyprus on 1 January 2018. He had lived in the United Arab Emirates since 2012, working for a large construction company Theodosis was appointed as the managing director of Mandarin Developers Ltd, a Cyprus tax resident company, from 1 January 2018. His annual gross salary was agreed at 110.000. In 2018 the PAYE deducted from Theodosis's salary was 10.500. Theodosis was provided immediately with a house by Mandarin Developers Ltd, for which the Company pald an annual rent of 12.000, and incurred ancillary services in 2018 as follows: Electricity Water 1.700 500 Theodosis is provided with a car by Mandarin, in order to visit their various construction sites and give Instructions to the builders. Theodosis' is the only employee of the company using the car and he could also use it for private purposes. The annual running expenses of the car are borne by Mandarin comprising road tax, insurance, fuel and repairs. The car was bought by the company in 2015 for 30.000 Theodosis himself made the following payments in 2018 Subscription to ETEK (professional body) Donation to AEL FC (football club) Donation to an approved charity Professional development seminar related to his job Social insurance contributions in accordance with the applicable rates Life insurance in his own name sum assured 100.000) 300 500 300 200 8.3% 8.000 Theodosis receives rental income from a luxury flat in Paphos which he owns jointly with his wife, Maroulla. The flat was acquired during 1999 for 300 000 (including land of 100.000). The total rents received by both were 24 000, and they had paid 2 400 interest on the loan they had taken out in order to buy the rental property Required: Theodosis himself made the following payments in 2018: Subscription to ETEK (professional body) Donation to AEL FC (football club) Donation to an approved charity Professional development seminar related to his job Social insurance contributions in accordance with the applicable rates Life insurance in his own name (sum assured 100.000) 300 500 300 200 8.3% 8.000 Theodosis receives rental income from a luxury flat in Paphos which he owns jointly with his wife, Maroulla. The flat was acquired during 1999 for 300.000 (including land of 100.000). The total rents received by both were 24.000, and they had paid 2.400 interest on the loan they had taken out in order to buy the rental property Required: (1) Calculate the tax payable by/refundable to Theodosis Theodosiou for the year 2018, assuming that he will take advantage of all available exemptions. (15 marks) (ii) Briefly outline the conditions applicable to each of the exemptions available to Theodosis Theodosiou in respect of his employment income in 2018

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts