Question: A project will cost $1000 at time, and is expected to produce $1200 at time 1, and no other cashflows. If the firm uses all

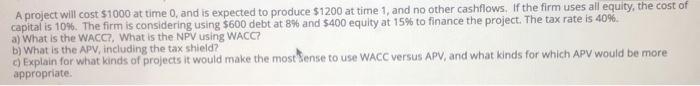

A project will cost $1000 at time, and is expected to produce $1200 at time 1, and no other cashflows. If the firm uses all equity, the cost of capital is 10%. The firm is considering using $600 debt at 8% and 5400 equity at 15% to finance the project. The tax rate is 40%. a) What is the WACC?, What is the NPV using WACC? b) What is the APV, including the tax shield? c) Explain for what kinds of projects it would make the mostense to use WACC versus APV, and what kinds for which APV would be more appropriate

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts