Question: A project will last three years. The outcomes for the project are uncertain. The project might be successful and have three years of $1,500

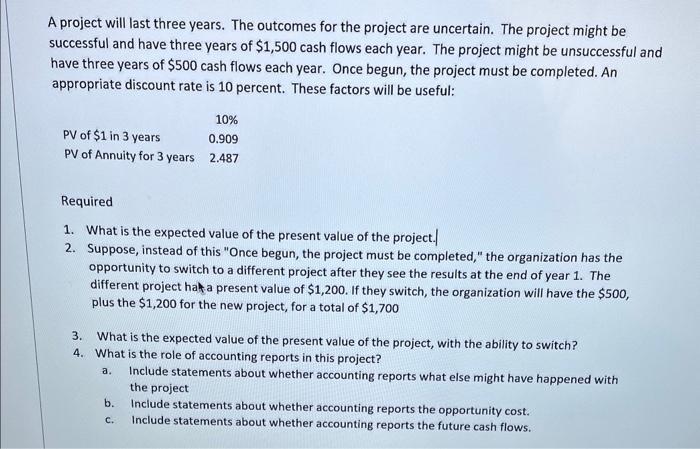

A project will last three years. The outcomes for the project are uncertain. The project might be successful and have three years of $1,500 cash flows each year. The project might be unsuccessful and have three years of $500 cash flows each year. Once begun, the project must be completed. An appropriate discount rate is 10 percent. These factors will be useful: PV of $1 in 3 years PV of Annuity for 3 years 10% 0.909 2.487 Required 1. What is the expected value of the present value of the project. 2. Suppose, instead of this "Once begun, the project must be completed," the organization has the opportunity to switch to a different project after they see the results at the end of year 1. The different project hak a present value of $1,200. If they switch, the organization will have the $500, plus the $1,200 for the new project, for a total of $1,700 3. What is the expected value of the present value of the project, with the ability to switch? 4. What is the role of accounting reports in this project? a. Include statements about whether accounting reports what else might have happened with the project Include statements about whether accounting reports the opportunity cost. Include statements about whether accounting reports the future cash flows. b. C.

Step by Step Solution

3.42 Rating (155 Votes )

There are 3 Steps involved in it

Expected value of the present value of the project Calculate the expected value Probability of success Ps 12 since there are two equally likely outcom... View full answer

Get step-by-step solutions from verified subject matter experts