Question: A project will not produce any cash flows for two years. Starting in the third year, it will produce annual cash flows of $45,600

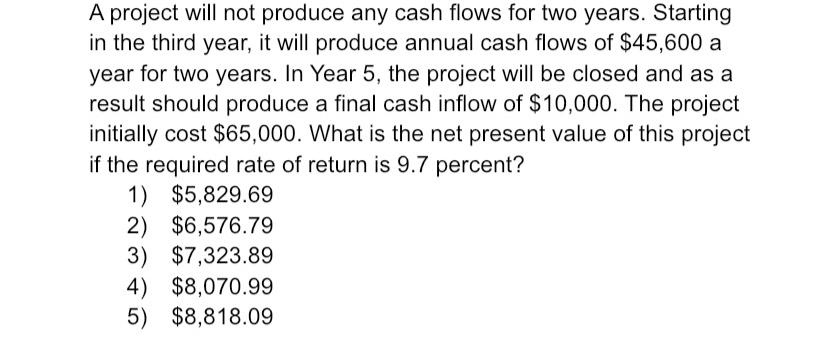

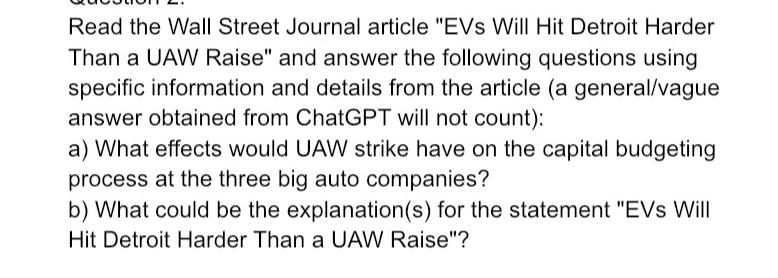

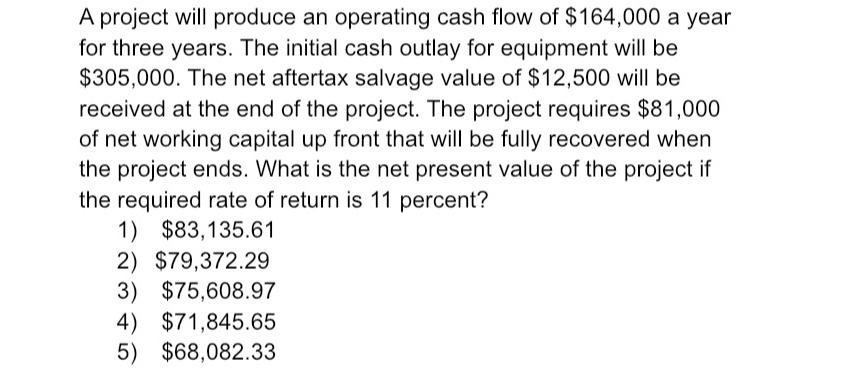

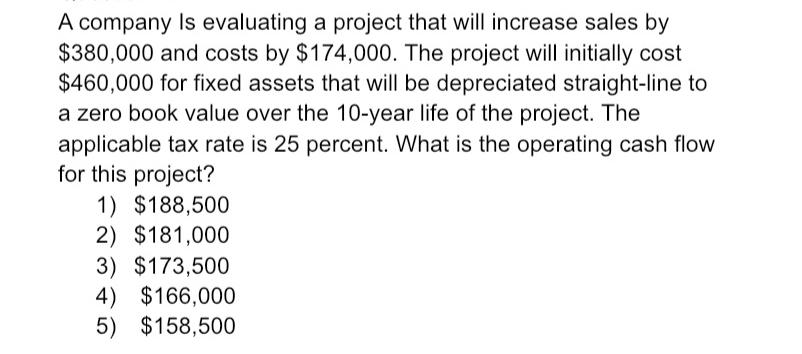

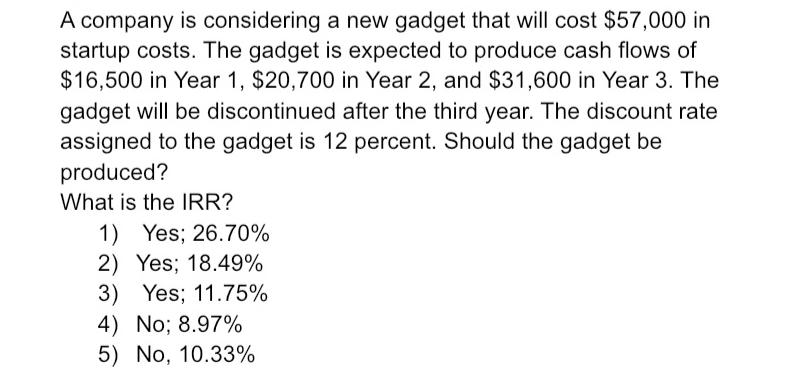

A project will not produce any cash flows for two years. Starting in the third year, it will produce annual cash flows of $45,600 a year for two years. In Year 5, the project will be closed and as a result should produce a final cash inflow of $10,000. The project initially cost $65,000. What is the net present value of this project if the required rate of return is 9.7 percent? 1) $5,829.69 2) $6,576.79 3) $7,323.89 4) $8,070.99 5) $8,818.09 Read the Wall Street Journal article "EVS Will Hit Detroit Harder Than a UAW Raise" and answer the following questions using specific information and details from the article (a general/vague answer obtained from ChatGPT will not count): a) What effects would UAW strike have on the capital budgeting process at the three big auto companies? b) What could be the explanation(s) for the statement "EVs Will Hit Detroit Harder Than a UAW Raise"? A project will produce an operating cash flow of $164,000 a year for three years. The initial cash outlay for equipment will be $305,000. The net aftertax salvage value of $12,500 will be received at the end of the project. The project requires $81,000 of net working capital up front that will be fully recovered when the project ends. What is the net present value of the project if the required rate of return is 11 percent? 1) $83,135.61 2) $79,372.29 3) $75,608.97 4) $71,845.65 5) $68,082.33 A company Is evaluating a project that will increase sales by $380,000 and costs by $174,000. The project will initially cost $460,000 for fixed assets that will be depreciated straight-line to a zero book value over the 10-year life of the project. The applicable tax rate is 25 percent. What is the operating cash flow for this project? 1) $188,500 2) $181,000 3) $173,500 4) $166,000 5) $158,500 A company is considering a new gadget that will cost $57,000 in startup costs. The gadget is expected to produce cash flows of $16,500 in Year 1, $20,700 in Year 2, and $31,600 in Year 3. The gadget will be discontinued after the third year. The discount rate assigned to the gadget is 12 percent. Should the gadget be produced? What is the IRR? 1) Yes; 26.70% 2) Yes; 18.49% 3) Yes; 11.75% 4) No; 8.97% 5) No, 10.33%

Step by Step Solution

3.51 Rating (154 Votes )

There are 3 Steps involved in it

Lets calculate the net present value NPV for each of the given projects 1 Project with Cash Flows Ye... View full answer

Get step-by-step solutions from verified subject matter experts