Question: A proposed farm project has a three-year development period during which farmers borrow $4000/year (real) at the beginning of each year. At the beginning

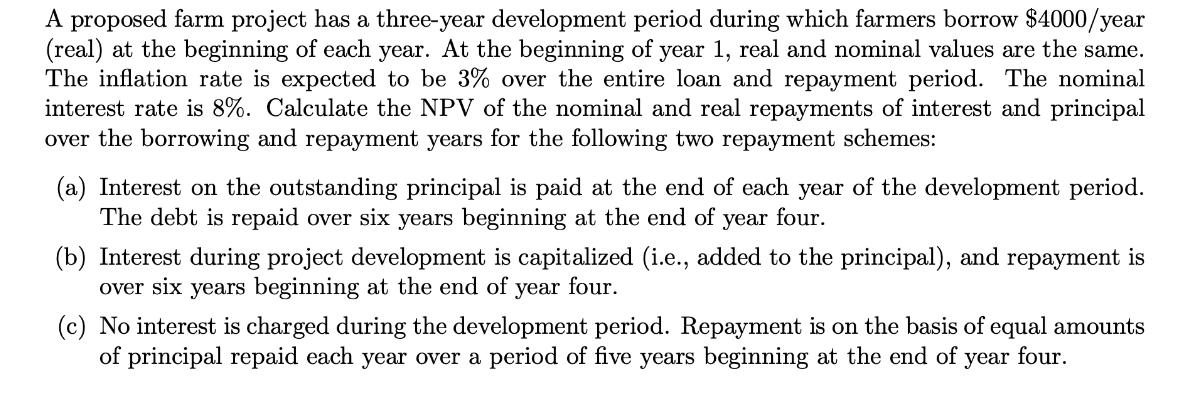

A proposed farm project has a three-year development period during which farmers borrow $4000/year (real) at the beginning of each year. At the beginning of year 1, real and nominal values are the same. The inflation rate is expected to be 3% over the entire loan and repayment period. The nominal interest rate is 8%. Calculate the NPV of the nominal and real repayments of interest and principal over the borrowing and repayment years for the following two repayment schemes: (a) Interest on the outstanding principal is paid at the end of each year of the development period. The debt is repaid over six years beginning at the end of year four. (b) Interest during project development is capitalized (i.e., added to the principal), and repayment is over six years beginning at the end of year four. (c) No interest is charged during the development period. Repayment is on the basis of equal amounts of principal repaid each year over a period of five years beginning at the end of year four.

Step by Step Solution

3.42 Rating (152 Votes )

There are 3 Steps involved in it

To calculate the NPV Net Present Value of the nominal and real repayments for the two repayment schemes we need to discount the cash flows to their present values We will consider the real cash flows ... View full answer

Get step-by-step solutions from verified subject matter experts