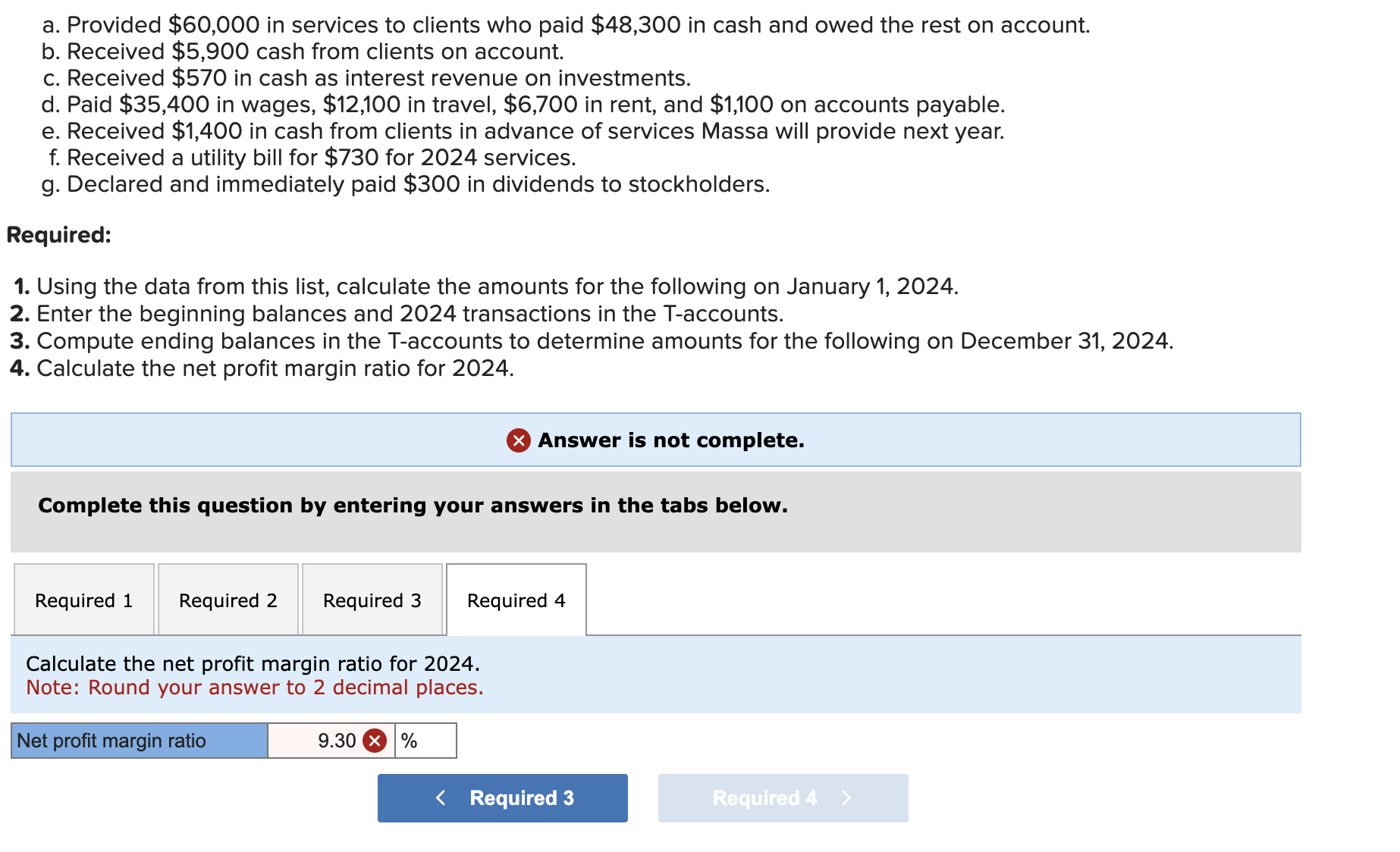

Question: a . Provided $ 6 0 , 0 0 0 in services to clients who paid $ 4 8 , 3 0 0 in cash

a Provided $ in services to clients who paid $ in cash and owed the rest on account.

b Received $ cash from clients on account.

c Received $ in cash as interest revenue on investments.

d Paid $ in wages, $ in travel, $ in rent, and $ on accounts payable.

e Received $ in cash from clients in advance of services Massa will provide next year.

f Received a utility bill for $ for services.

g Declared and immediately paid $ in dividends to stockholders.

Required:

Using the data from this list, calculate the amounts for the following on January

Enter the beginning balances and transactions in the Taccounts.

Compute ending balances in the Taccounts to determine amounts for the following on December

Calculate the net profit margin ratio for

Answer is not complete.

Complete this question by entering your answers in the tabs below.

Required

Required

Calculate the net profit margin ratio for

Note: Round your answer to decimal places.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock