Question: A. PUT contract How much money will this purchase cost you? Is this option in-the-money or out-of-the-money? If on 2/15, the D J I A

A. PUT contract

- How much money will this purchase cost you?

- Is this option in-the-money or out-of-the-money?

- If on 2/15, the D J I A price happens to be $270, how much will your contract pay?

B. CALL contract

- How much money will this purchase cost you?

- Is this option in-the-money or out-of-the-money?

- If on 2/15, the D J I A price happens to be $270, how much will your contract pay?

C. Can you think of what Call - Put price should be?

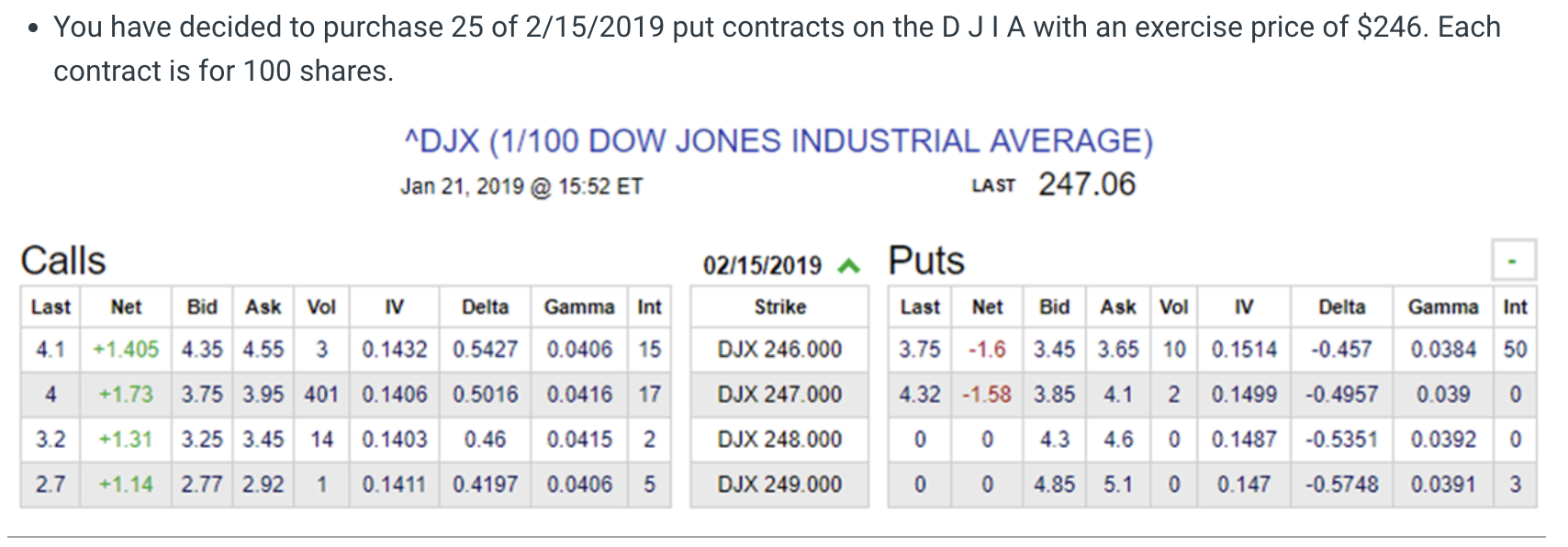

. You have decided to purchase 25 of 2/15/2019 put contracts on the DJTA with an exercise price of $246. Each contract is for 100 shares. ^DJX (1/100 DOW JONES INDUSTRIAL AVERAGE) Jan 21, 2019 @ 15:52 ET LAST 247.06 . Gamma Int Calls Last Net Bid Ask Vol IV Delta Gamma Int 4.1 +1.405 4.35 4.55 3 0.1432 0.5427 0.0406 15 4 +1.73 3.75 3.95 401 0.1406 0.5016 0.0416 17 3.2 +1.31 3.25 3.45 14 0.1403 0.46 0.0415 2 02/15/2019 ^ Puts Strike Last Net Bid Ask Vol IV Delta DJX 246.000 3.75 -1.6 3.45 3.65 10 0.1514 -0.457 DJX 247.000 4.32 -1.58 3.85 4.1 2 0.1499 -0.4957 DJX 248.000 0 0 4.3 4.6 0 0.1487 -0.5351 DJX 249.000 0 0 4.85 5.1 0 0.147 -0.5748 0.0384 50 0.039 0 0.0392 0 2.7 +1.14 2.77 2.92 1 0.1411 0.4197 0.0406 5 0.0391 3 . You have decided to purchase 25 of 2/15/2019 put contracts on the DJTA with an exercise price of $246. Each contract is for 100 shares. ^DJX (1/100 DOW JONES INDUSTRIAL AVERAGE) Jan 21, 2019 @ 15:52 ET LAST 247.06 . Gamma Int Calls Last Net Bid Ask Vol IV Delta Gamma Int 4.1 +1.405 4.35 4.55 3 0.1432 0.5427 0.0406 15 4 +1.73 3.75 3.95 401 0.1406 0.5016 0.0416 17 3.2 +1.31 3.25 3.45 14 0.1403 0.46 0.0415 2 02/15/2019 ^ Puts Strike Last Net Bid Ask Vol IV Delta DJX 246.000 3.75 -1.6 3.45 3.65 10 0.1514 -0.457 DJX 247.000 4.32 -1.58 3.85 4.1 2 0.1499 -0.4957 DJX 248.000 0 0 4.3 4.6 0 0.1487 -0.5351 DJX 249.000 0 0 4.85 5.1 0 0.147 -0.5748 0.0384 50 0.039 0 0.0392 0 2.7 +1.14 2.77 2.92 1 0.1411 0.4197 0.0406 5 0.0391 3

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts