Question: 1. PUT contract How much money will this purchase cost you? Is this option in-the-money or out-of-the-money? If on 2/15, the D J I A

1. PUT contract

1. PUT contract

- How much money will this purchase cost you?

- Is this option in-the-money or out-of-the-money?

- If on 2/15, the D J I A price happens to be $270, how much will your contract pay?

2. CALL contract

- How much money will this purchase cost you?

- Is this option in-the-money or out-of-the-money?

- If on 2/15, the D J I A price happens to be $270, how much will your contract pay?

3. (bonus question) Recall the payouts pictures of the call and put options (hockey sticks). Can you draw a graph for the portfolio consisting of the long position in a call option and a short position in a put option ? According to the data on DJIA, how much will this portfolio cost to construct?

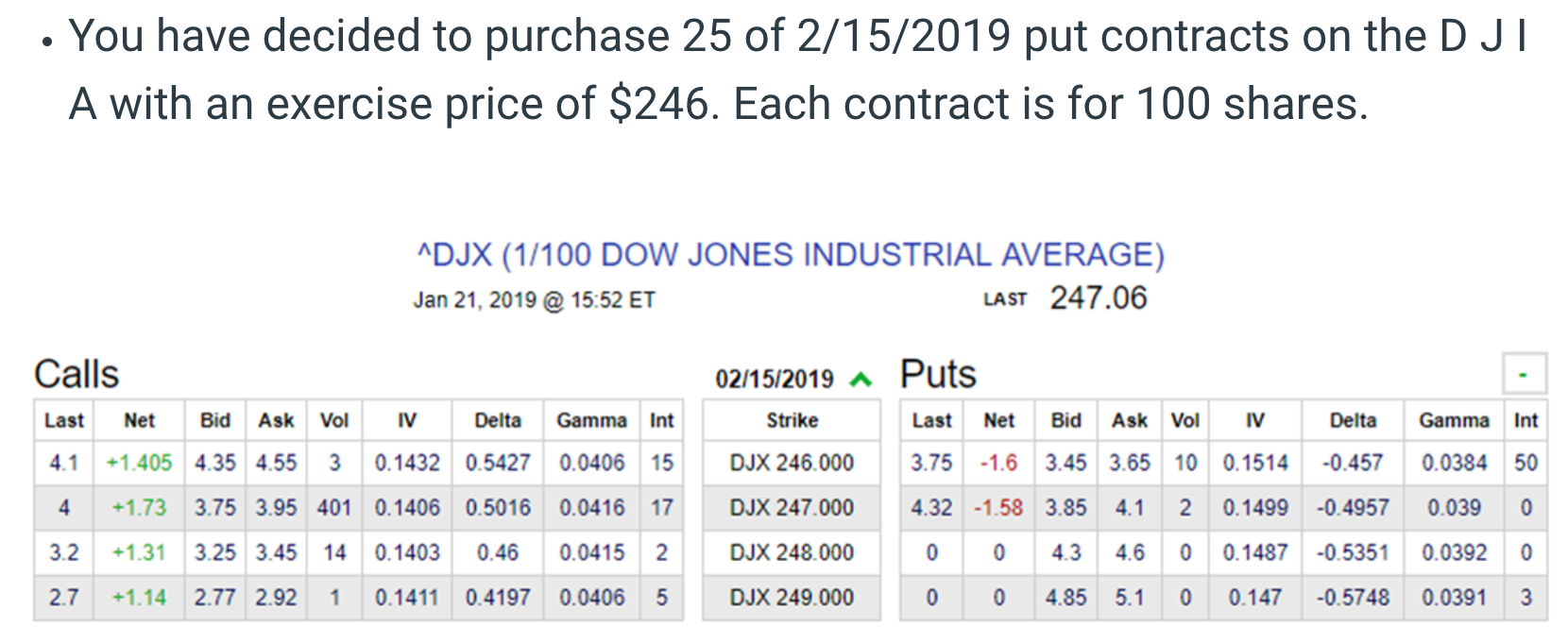

You have decided to purchase 25 of 2/15/2019 put contracts on the DJI A with an exercise price of $246. Each contract is for 100 shares. ^DJX (1/100 DOW JONES INDUSTRIAL AVERAGE) Jan 21, 2019 @ 15:52 ET LAST 247.06 Calls Last Net Bid Ask Vol IV Delta Gamma Int

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock