Question: A put option's value increases as v. 0 time to expiration increases, the risk-free rate increases, and volatility of the underlying increases. b. time to

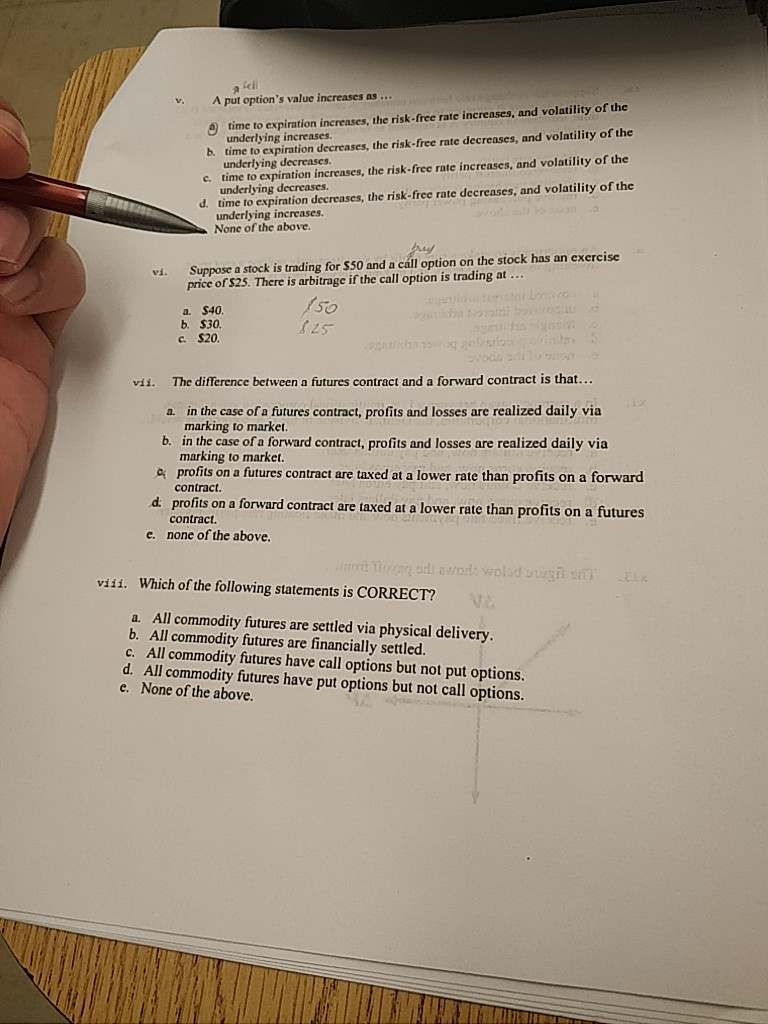

A put option's value increases as v. 0 time to expiration increases, the risk-free rate increases, and volatility of the underlying increases. b. time to expiration decreases, the risk-free rate decreases, and volatility of the underlying decreases c. time to expiration increases, the risk-free rate increases, and volatility of the underlying decreases. d. time to expiration decreases, the risk-free rate decreases, and volatility of the underlying increases. None of the above Suppose a stock is trading for $50 and a call option on the stock has an exercise price of $25. There is arbitrage if the call option is trading at vi. so 2s a. $40 b S30. e $20 The difference between a futures contract and a forward contract is that. vii. a. in the case of a futures contract, profits and losses are realized daily via marking to market. b. in the case of a forward contract, profits and losses are realized daily via marking to market a profits on a futures contract are taxed at a lower rate than profits on a forward contract. d profits on a forward contract are taxed at a lower rate than profits on a futures contract. none of the above. e. Which of the following statements is CORRECT? viii. a. All commodity futures are settled via physical delivery b. All commodity futures are financially settled. c. All commodity futures have call options but not put options. d. All commodity futures have put options but not call options. e. None of the above

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts