Question: A put or call option on a stock has exercise price equal to 8. The current price is 10. Assuming the price (p) is distributed

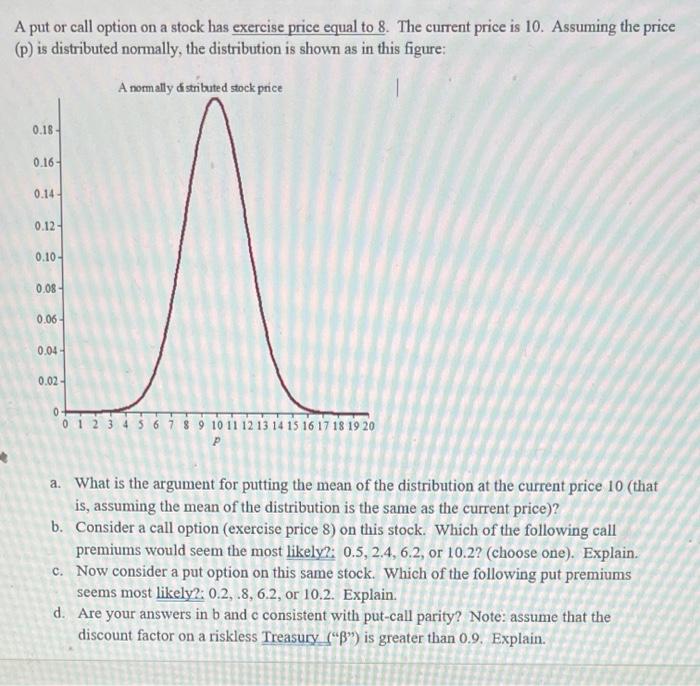

A put or call option on a stock has exercise price equal to 8. The current price is 10. Assuming the price (p) is distributed normally, the distribution is shown as in this figure: A normally distributed stock price 0.18 0.16- 0.14 0.12 0.10- 0.08 0.06 0.04 0.02- 0 0.12 1$ 9 10 11 12 13 14 15 16 17 18 19 20 a. What is the argument for putting the mean of the distribution at the current price 10 (that is, assuming the mean of the distribution is the same as the current price)? b. Consider a call option (exercise price 8) on this stock. Which of the following call premiums would seem the most likely2: 0.5, 2.4, 6.2, or 10.2? (choose one). Explain. c. Now consider a put option on this same stock. Which of the following put premiums seems most likely2: 0.2, 8, 6.2, or 10.2. Explain. d. Are your answers in b and c consistent with put-call parity? Note: assume that the discount factor on a riskless Treasury ("B") is greater than 0.9. Explain

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts