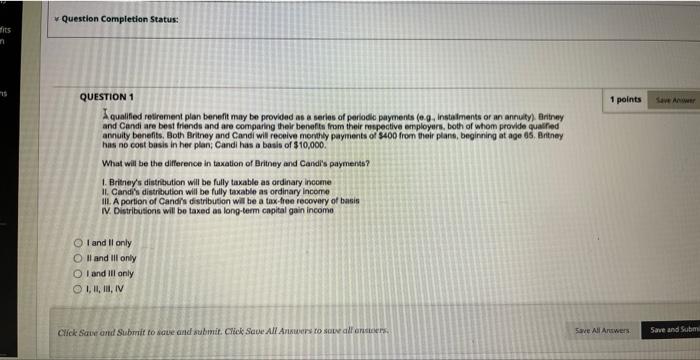

Question: A qualified retirement plan benefit may be provided as a series of periodic payments (e.g. instaimants of an annuly). Eniney and Candi are best triends

A qualified retirement plan benefit may be provided as a series of periodic payments (e.g. instaimants of an annuly). Eniney and Candi are best triends and are comparing their benefts from their mepective employers, both of whom provide gualfed annuity benefits. Both Britney and Candi will receive monthey payments of 300 from their plant, beginning at age 05 , Brteney has no cont basis in her plan; Candi has a basis of $10,000. What will be the difference in taxation of Brithey and Candi's payments? 1. Britineyss dietritution will be fully taxable as ordinary ineome II. Candi's distribution will be fully taxable as ordinary income III. A portion of Candifn distribution will be a tax-tree recovery of basis N. Distribusions will be taxed as long-term capital gain income I and I1 only II and III only I and 111 only 1, 1i, 1iI, IV Click Save ond Suburit to save and submat. Cicks Sane All Answers to sowe all entinem

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts