Question: a ) QUESTION ONE b ) Derive the complex money multiplier formula. b ) Suppose that the central bank buys bonds from the public worth

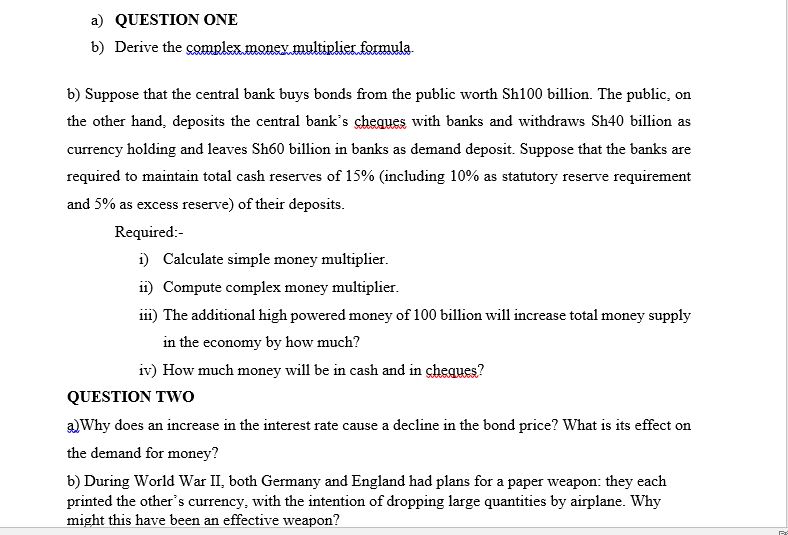

a QUESTION ONE

b Derive the complex money multiplier formula.

b Suppose that the central bank buys bonds from the public worth Sh billion. The public, on

the other hand, deposits the central bank's cheques with banks and withdraws Sh billion as

currency holding and leaves Sh billion in banks as demand deposit. Suppose that the banks are

required to maintain total cash reserves of including as statutory reserve requirement

and as excess reserve of their deposits.

Required:

i Calculate simple money multiplier.

ii Compute complex money multiplier.

iii The additional high powered money of billion will increase total money supply

in the economy by how much?

iv How much money will be in cash and in cheques?

QUESTION TWO

aWhy does an increase in the interest rate cause a decline in the bond price? What is its effect on

the demand for money?

b During World War II both Germany and England had plans for a paper weapon: they each

printed the other's currency, with the intention of dropping large quantities by airplane. Why

might this have been an effective weapon?

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock