Question: a Rasheed is facing a dilemma. He is considering whether to purchase a home or to continue living with his parents in Merced, California. His

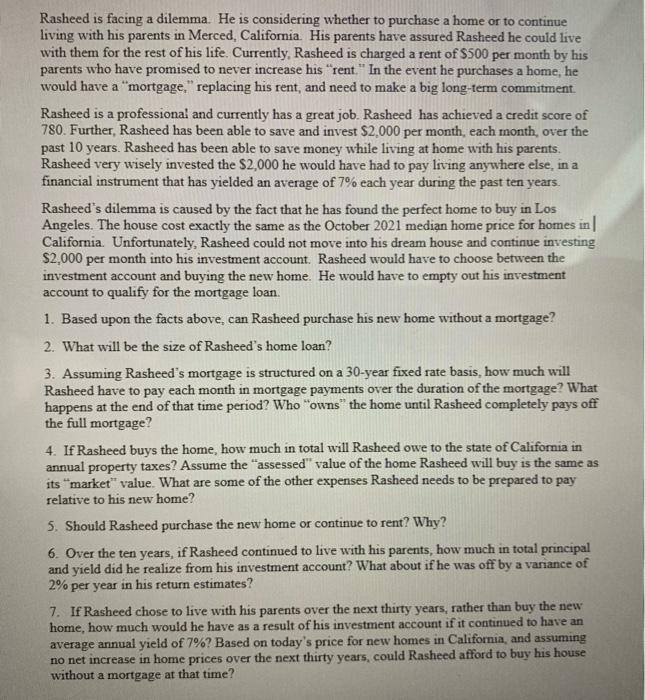

a Rasheed is facing a dilemma. He is considering whether to purchase a home or to continue living with his parents in Merced, California. His parents have assured Rasheed he could live with them for the rest of his life. Currently, Rasheed is charged a rent of $500 per month by his parents who have promised to never increase his "rent." In the event he purchases a home, he would have a "mortgage," replacing his rent, and need to make a big long-term commitment Rasheed is a professional and currently has a great job. Rasheed has achieved a credit score of 780. Further, Rasheed has been able to save and invest $2,000 per month, each month, over the past 10 years. Rasheed has been able to save money while living at home with his parents. Rasheed very wisely invested the $2,000 he would have had to pay living anywhere else, in a financial instrument that has yielded an average of 7% each year during the past ten years. Rasheed's dilemma is caused by the fact that he has found the perfect home to buy in Los Angeles. The house cost exactly the same as the October 2021 median home price for homes in California. Unfortunately, Rasheed could not move into his dream house and continue investing $2,000 per month into his investment account. Rasheed would have to choose between the investment account and buying the new home. He would have to empty out his investment account to qualify for the mortgage loan. 1. Based upon the facts above, can Rasheed purchase his new home without a mortgage? 2. What will be the size of Rasheed's home loan? 3. Assuming Rasheed's mortgage is structured on a 30-year fixed rate basis, how much will Rasheed have to pay each month in mortgage payments over the duration of the mortgage? What happens at the end of that time period? Who "owns" the home until Rasheed completely pays off the full mortgage? 4. If Rasheed buys the home, how much in total will Rasheed owe to the state of California in annual property taxes? Assume the assessed" value of the home Rasheed will buy is the same as "market" value. What are some of the other expenses Rasheed needs to be prepared to pay relative to his new home? 5. Should Rasheed purchase the new home or continue to rent? Why? 6. Over the ten years, if Rasheed continued to live with his parents, how much in total principal and yield did he realize from his investment account? What about if he was off by a variance of 2% per year in his return estimates? 7. If Rasheed chose to live with his parents over the next thirty years, rather than buy the new home, how much would he have as a result of his investment account if it continued to have an average annual yield of 7%? Based on today's price for new homes in California, and assuming no net increase in home prices over the next thirty years, could Rasheed afford to buy his house without a mortgage at that time? its a Rasheed is facing a dilemma. He is considering whether to purchase a home or to continue living with his parents in Merced, California. His parents have assured Rasheed he could live with them for the rest of his life. Currently, Rasheed is charged a rent of $500 per month by his parents who have promised to never increase his "rent." In the event he purchases a home, he would have a "mortgage," replacing his rent, and need to make a big long-term commitment Rasheed is a professional and currently has a great job. Rasheed has achieved a credit score of 780. Further, Rasheed has been able to save and invest $2,000 per month, each month, over the past 10 years. Rasheed has been able to save money while living at home with his parents. Rasheed very wisely invested the $2,000 he would have had to pay living anywhere else, in a financial instrument that has yielded an average of 7% each year during the past ten years. Rasheed's dilemma is caused by the fact that he has found the perfect home to buy in Los Angeles. The house cost exactly the same as the October 2021 median home price for homes in California. Unfortunately, Rasheed could not move into his dream house and continue investing $2,000 per month into his investment account. Rasheed would have to choose between the investment account and buying the new home. He would have to empty out his investment account to qualify for the mortgage loan. 1. Based upon the facts above, can Rasheed purchase his new home without a mortgage? 2. What will be the size of Rasheed's home loan? 3. Assuming Rasheed's mortgage is structured on a 30-year fixed rate basis, how much will Rasheed have to pay each month in mortgage payments over the duration of the mortgage? What happens at the end of that time period? Who "owns" the home until Rasheed completely pays off the full mortgage? 4. If Rasheed buys the home, how much in total will Rasheed owe to the state of California in annual property taxes? Assume the assessed" value of the home Rasheed will buy is the same as "market" value. What are some of the other expenses Rasheed needs to be prepared to pay relative to his new home? 5. Should Rasheed purchase the new home or continue to rent? Why? 6. Over the ten years, if Rasheed continued to live with his parents, how much in total principal and yield did he realize from his investment account? What about if he was off by a variance of 2% per year in his return estimates? 7. If Rasheed chose to live with his parents over the next thirty years, rather than buy the new home, how much would he have as a result of his investment account if it continued to have an average annual yield of 7%? Based on today's price for new homes in California, and assuming no net increase in home prices over the next thirty years, could Rasheed afford to buy his house without a mortgage at that time? its

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts