Question: A recent study found that American consumers are making average monthly debt payments of around $1,000 (Source: Experian.com, November 11, 2010). However, the study of

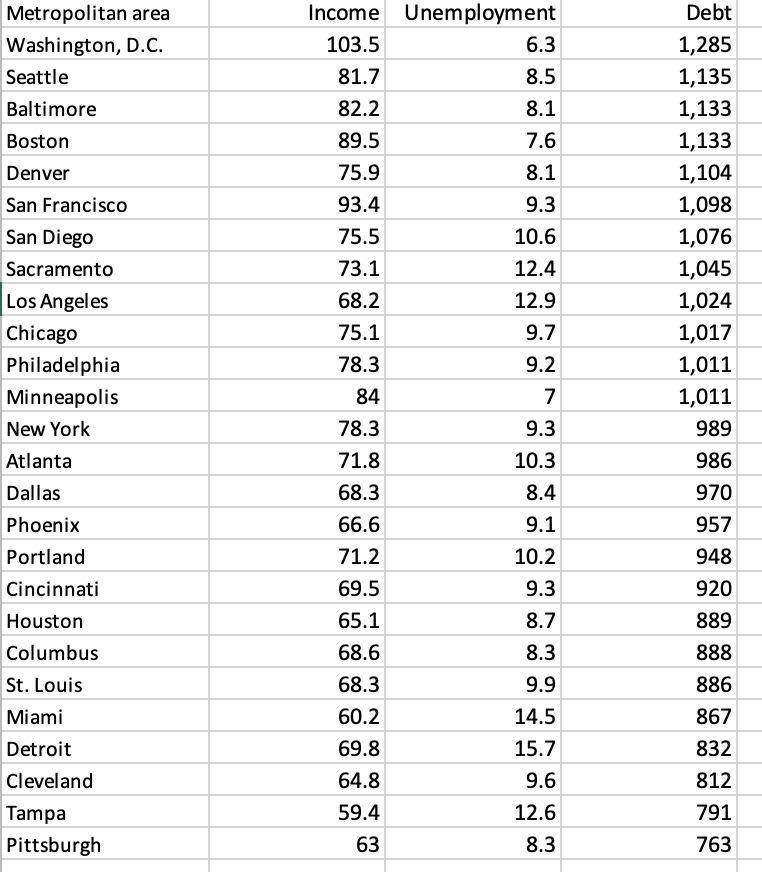

A recent study found that American consumers are making average monthly debt payments of around $1,000 (Source: Experian.com, November 11, 2010). However, the study of 26 metropolitan areas reveals quite a bit of variation in debt payments, depending on where the consumer lives. For instance, in Washington DC, residents pay the most ($1,285 per month), while Pittsburgh residents pay the least ($763 per month). Madelyn Davis, an economist in a large bank, believes that income differences between cities are the primary reason for the disparate debt payments. For example, Washington DC's high incomes have likely contributed to it placement on the list. She is also unsure about the likely effect of unemployment rate on consumer debt payments. In order to analyze the relationship between income, unemployment rate, and consumer debt payments, Madelyn collected data from the same 26 metropolitan cities used in the earlier debt payment study. Specifically, she gathered each area's 2010 - 2011 median household income (recorded in thousands of dollars) as well as the monthly unemployment rate and average consumer debt for August 2010.

Madelyn would like to use this sample data to understand the relationships between (1) debt payments and income, and (2) debt payments and unemployment rate.

\f

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts