Question: a. Record the journal entries for transactions 16. b. Posting to the ledger WIP Job #1 , Job # 2, and Job #3 Modern Building

Modern Building Solutions builds portable buildings to clients specific cations. The firm has two departments: Parts Fabrication and Assembly.

The Parts Fabrication Department designs and cuts the major components of the building and is highly automated.

The Assembly Department assembles and installs the components, and this department is highly labour intensive. The Assembly Department begins work on the buildings as soon as the floor components are available from the Parts Fabrication Department.

In its first month of operations (March 2010), Modern Building Solutions obtained

contracts for three buildings:

Job 1: a 20- by 40-foot storage building

Job 2: a 35- by 35-foot commercial utility building

Job 3: a 30- by 40-foot portable classroom

Modern Building Solutions bills its customers on a cost-plus basis, with profit t set equal to 35 percent of costs. The firm uses a job order costing system based on normal costs.

Overhead is applied in Parts Fabrication at a predetermined rate of $120 per machine hour (MH).

In the Assembly Department, overhead is applied at a predetermined rate of $17per direct labour hour (DLH). The following significant transactions occurred in March 2010:

jobs: Job #1, $17,000; Job #2, $35,000; and Job #3, $49,000. Direct material was issued to the Assembly Department: Job #1, $900; Job #2, $2,700; and Job #3, $7,900.

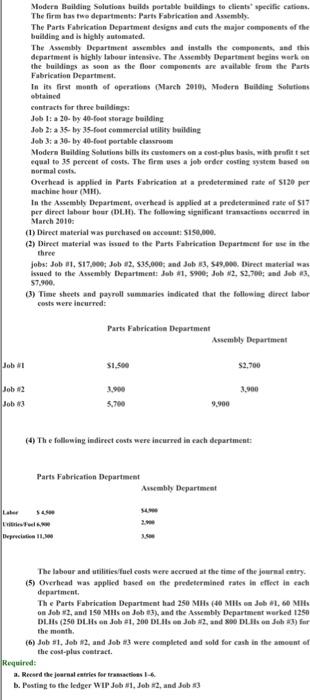

| Parts Fabrication Department |

Assembly Department

|

Job #1 | $1,500 | $2,700 |

Job #2 | 3,900 | 3,900 |

Job #3 | 5,700 | 9,900 |

| Parts Fabrication Department |

Assembly Department

|

Labor | $ 4,500 | $4,900 |

Utilities/Fuel | 6,900 | 2,900 |

Depreciation | 11,300 | 3,500 |

The labour and utilities/fuel costs were accrued at the time of the journal entry.

Th e Parts Fabrication Department had 250 MHs (40 MHs on Job #1, 60 MHs on Job #2, and 150 MHs on Job #3), and the Assembly Department worked 1250 DLHs (250 DLHs on Job #1, 200 DLHs on Job #2, and 800 DLHs on Job #3) for the month.

Required:

Modern Bailding Solutions beilds portable buildings to clicnts +specific cations. The firm has twe departments; Parts Fabrication and Assembly: The Parts Faterication Department deviges aed cuts the major components of the buling and is hichly automated. The Assembly Department ancmbles and instalh the coenposents, and this departnent is highly laboer intebsve. The Assembly Departmont begins werk en the buildings as soon as the floar componcmts are available frem the Parts Fabricatien Department. In ien first menth of operations (Mareh 2010h. Medern Builaine Solutions obtained contracts for three buildisis: Job 1: a 20- by 40-foet storaze beilding Job 3: a 35. by 35-foet cemmercial utility building Job 3i a 30-by 40-foet pertable clawroon Modere Beilding Selutions bills its cwstemers on a cost-pies bask, with prefit t set equal to 35 perceat of costs. The firm ases a job erder costing wytem bascd en nertal cests. Overhead is applied in Parts Falurication at a prodetermined rate of s120 per machise hour (MH). In the Asembly Department, oucrbead is applied at a predetermined rate of 517 per direct labour bour (DW.M). The follewing significant transactions eccurred in Warch 2010 a (1) Direct material was perchased en acceunt: 51s0,e00. (2) Dircet material was hosed te the Parts Fahrication Departacht for wes in the three johst Job a1, 517,000; Job a2, 535,000; and Job M3, 549,000. Dinect material was issued to the Awembly thepartment: Jeb in, \$5\%0; Job N2, \$2,700; and Jeb as, 57,900. (3) Time sheets and payroll summaries indicated that the following direct taber cests were incurred: (4) Th e follewing indirect cests were incurred in each dcpartiment: The labour and utititiesfuel costs were accrued at the time of the journal cetry. (5) Overhead was applied based en the predetermined rates in effect in each department. The Parts Fabrication Bepartment had 250 M14s (40 Mils en Jes 41 , 60 MHs on Jobe it2, wnd 150 MHs oe Jeb at?), and the Assembly Department werked 1250 the masth, (b) Job 11 , Job il2, and Jeb at were completed asd sold for cask in the mmoent of the cost-plus coetract. Requirsd: a. Record the jearnal oweries for tramacdions 1- - . b. Pesting to the ledger WIP Jeb 31 , Job m2, and Job 33

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts