Question: - A recording system that updates the inventory account each item inventory is bought or sold - a recording system that updates the inventory account

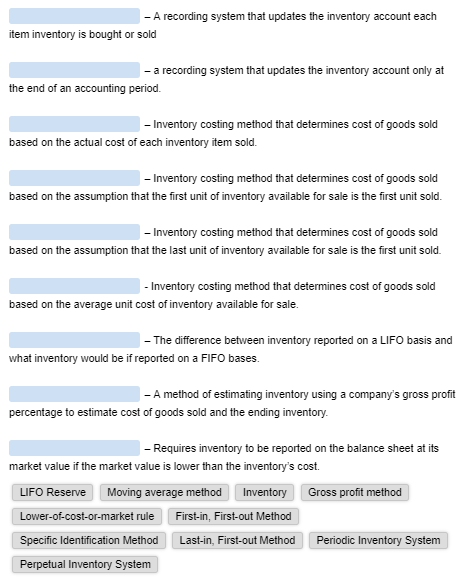

- A recording system that updates the inventory account each item inventory is bought or sold - a recording system that updates the inventory account only at the end of an accounting period. - Inventory costing method that determines cost of goods sold based on the actual cost of each inventory item sold. - Inventory costing method that determines cost of goods sold based on the assumption that the first unit of inventory available for sale is the first unit sold - Inventory costing method that determines cost of goods sold based on the assumption that the last unit of inventory available for sale is the first unit sold. - Inventory costing method that determines cost of goods sold based on the average unit cost of inventory available for sale. - The difference between inventory reported on a LIFO basis and what inventory would be if reported on a FIFO bases. - A method of estimating inventory using a company's gross profit percentage to estimate cost of goods sold and the ending inventory. - Requires inventory to be reported on the balance sheet at its market value if the market value is lower than the inventory's cost. Gross profit method LIFO Reserve Moving average method Inventory Lower-of-cost-or-market rule First-in, First-out Method Specific Identification Method Last-in, First-out Method Perpetual Inventory System Periodic Inventory System

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts