Question: A replacement machine can be purchased now for $7,800. It would be used for 6 years, and depreciated straight line. It will result in additional

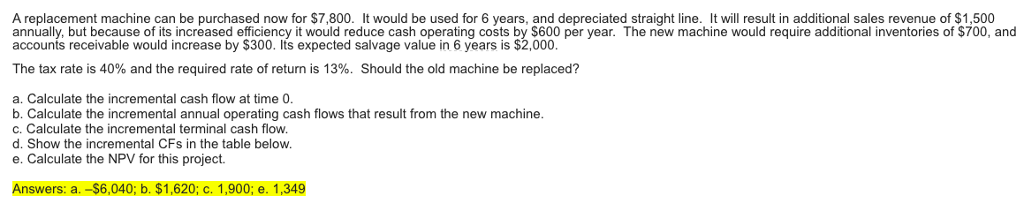

A replacement machine can be purchased now for $7,800. It would be used for 6 years, and depreciated straight line. It will result in additional sales revenue of $1,500 annually, but because of its increased efficiency it would reduce cash operating costs by $600 per year. The new machine would require additional inventories of $700, and accounts receivable would increase by $300. lts expected salvage value in 6 years is $2,000 The tax rate is 40% and the required rate of return is 13%. Should the old machine be replaced? a. Calculate the incremental cash flow at time 0 b. Calculate the incremental annual operating cash flows that result from the new machine c. Calculate the incremental terminal cash flow. d. Show the incremental CFs in the table below e. Calculate the NPV for this project. Answers: a. -$6,040; b. $1,620; c. 1,900; e. 1,349 A replacement machine can be purchased now for $7,800. It would be used for 6 years, and depreciated straight line. It will result in additional sales revenue of $1,500 annually, but because of its increased efficiency it would reduce cash operating costs by $600 per year. The new machine would require additional inventories of $700, and accounts receivable would increase by $300. lts expected salvage value in 6 years is $2,000 The tax rate is 40% and the required rate of return is 13%. Should the old machine be replaced? a. Calculate the incremental cash flow at time 0 b. Calculate the incremental annual operating cash flows that result from the new machine c. Calculate the incremental terminal cash flow. d. Show the incremental CFs in the table below e. Calculate the NPV for this project. Answers: a. -$6,040; b. $1,620; c. 1,900; e. 1,349

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts